In general, Canadians weathered the pandemic similarly to their southern neighbours, although there were a few key differences, including more lockdowns and a much higher adherence to mask and vaccine recommendations. Also affecting Canadian shopper behaviour were regulations on functions deemed “essential” vs. “non-essential,” which left less access to in-person shopping at select store categories, including dollar stores.

In this blog post, we provide an overview of the shopping behaviour of Canadian pet owners throughout the COVID-19 pandemic and the year that followed. This analysis compares two time periods: March 2020 through March 2021 and March 2021 through March 2022.

Fido Fidelity

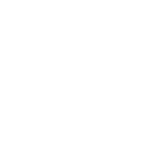

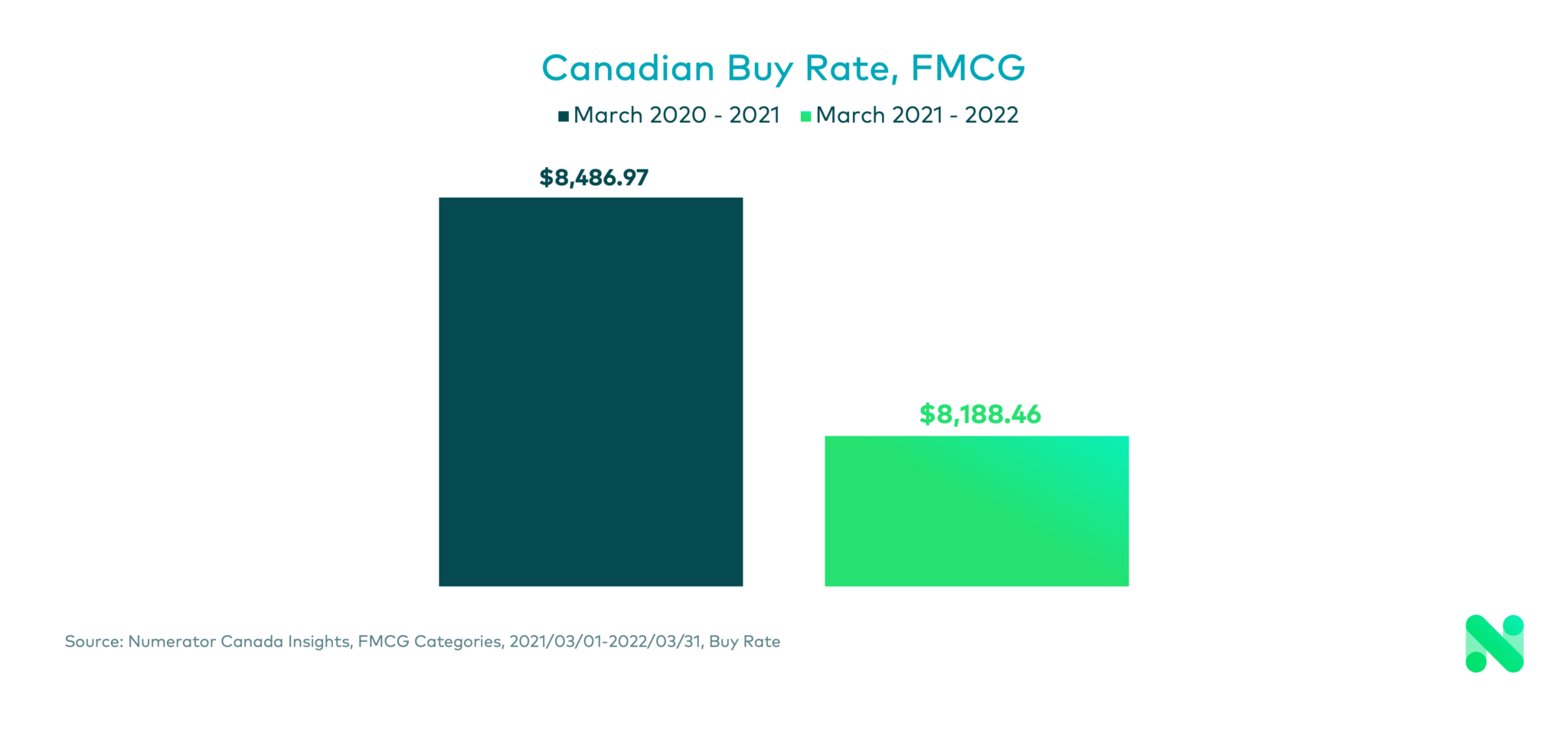

When times are tight, Canadian pet owners don’t deprive their furry family members. Although Canadians spent less overall on Consumer Packaged Goods during the pandemic, they increased their spending on food and treats for their pets. Overall Fast Moving-Consumer Goods (FMCG, also known as Consumer Packaged Goods or CPG) spend decreased by 3% in the previous 12 months as compared to the same period a year ago. During the same comparative period, purchases on pet food and treats increased by 2%.

The increase in buy rate for cat and dog food and treats shows a direct correlation to the number of trips made to buy those products. That number has increased by 15% over the same period a year ago. It is interesting to note that while the number of trips in March 2022 also increased significantly over the the previous month–February 2022 reflected the fewest number of trips in the past 12 month period–the March 2022 numbers have not yet reached the same levels as their 12-month high in July 2021, when Canada first loosened restrictions on essential in-store shopping.

The average spend per trip of $15.57 in March 2022 remained fairly consistent with the spend per trip a year ago, but it remains well below the $16.46 spend per trip reported in January 2022, which suggest shoppers may have stockpiled pet supplies during the last wave of the COVID lock downs.

Dollar Store Developments

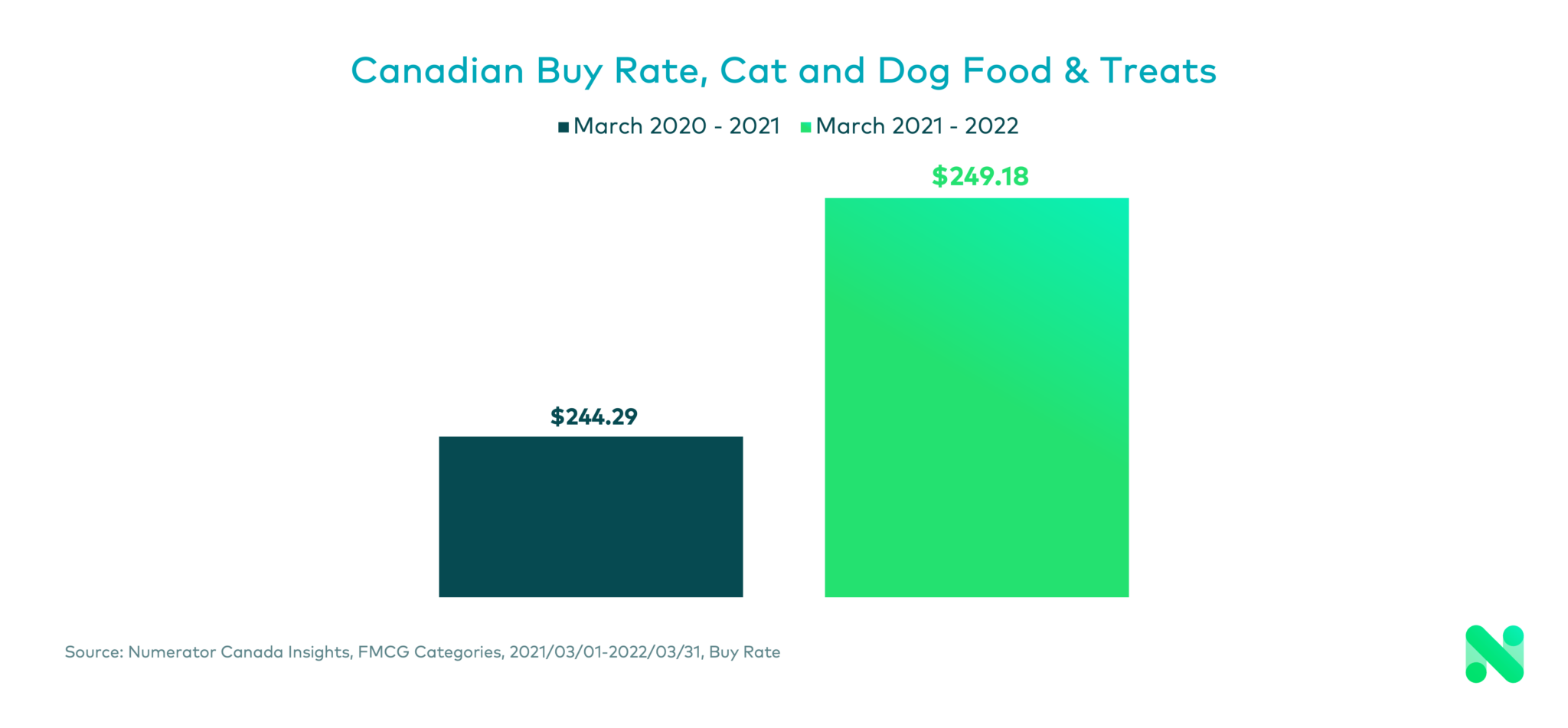

While grocery stores (39%) and mass retailers such as Walmart (31%) remain the most popular choice for pet parents, dollar stores have seen the largest growth in share with respect to the number of trips made during the past 12 months. This growth is especially telling since dollar stores remained off limits to shoppers for a portion of the past year.

Dollar stores also reflected the largest growth in household spend over the previous 12 months, although consumers have increased their spending on pet products in all retail channels.

More Kibbles and Bits

While pet owners have increased their spend on all pet products over the past year, it looks like large dogs are getting the short end of the stick when it comes to doggie snacks. Our study found that owners of large dogs spent 7% less on treats than small dog owners. Never fear, large dog owners did spend a whopping 61% more on food for their pets than small dog owners. Could it be that Newfoundland pups are tipping the scales for this study?

The Wrap Up

Canadians are a pet-loving society and not even a global pandemic can diminish their spending on pet food and pet treats. Their spend on pet products increased even as they cut back on other consumer essentials.

Meanwhile, owners of large dogs appear to be less committed to purchasing doggie treats for their furry children than owners of small dogs, but are spending considerably more on feeding their pets. If you’re surprised by these results, be sure to ask us about Numerator’s Dog and Cat Owner Premium People Groups to learn more.