As the monthlong delay on the Trump administration’s planned 25% tariffs on imports from Canada draws to a close, the news of a potential trade war— and the implications for the Canadian economy and consumers— have garnered significant attention from Canadian consumers. More than two-thirds (67%) of Canadians are closely following news on the topic, making it the most followed issue right now—outpacing even the potential federal election, provincial elections, and global conflicts. This heightened interest highlights the need for Canadian brands and retailers to understand how tariff impacts might shape consumer purchasing behaviour.

All Eyes on Tariffs: A Snapshot of Consumer Concern

When compared to other current events, tariffs are top of mind for Canadian consumers. To put it in perspective:

- 67% of Canadian consumers are closely following the tariffs news

- 41% of consumers are following the potential federal election closely

- 39% are keeping tabs on economic news

- 37% are paying attention to access to healthcare

- 37% are following provincial elections

These numbers illustrate a clear shift in attention. For many Canadians, the potential impact of tariffs on their wallets and everyday purchasing decisions has eclipsed other important political and social issues.

Buy Canadian Sentiment: Tariff-Driven Patriotism is on the Rise

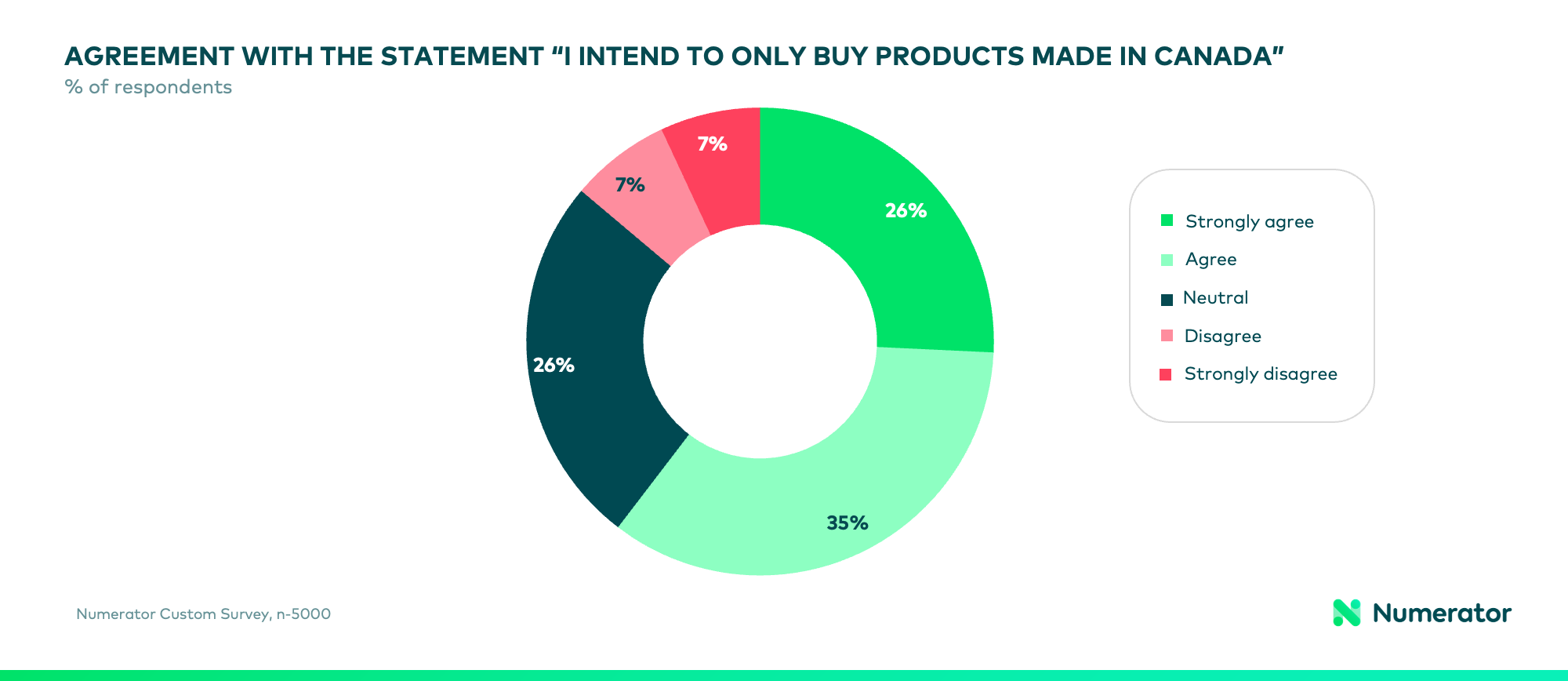

In response to the U.S. tariff news, many Canadian consumers have expressed a strong preference for Canadian-made products. When asked about their purchase intentions, 61% of Canadian consumers indicated they are either very likely or somewhat likely to seek out Canadian-made goods in light of potential tariffs. Only 14% of consumers disagreed or strongly disagreed with Buy Canadian sentiment.

This shift in buying behaviour highlights an important opportunity for brands based in Canada to position themselves as the “go-to” choice for consumers looking to support homegrown products. Even if no tariffs are ultimately levied by the U.S., 43% of Canadian consumers stated they are still likely to avoid purchasing U.S. products, demonstrating that this shift in preference might be a lasting trend.

Identifying Canadian-Owned Businesses: What Do Consumers Look For?

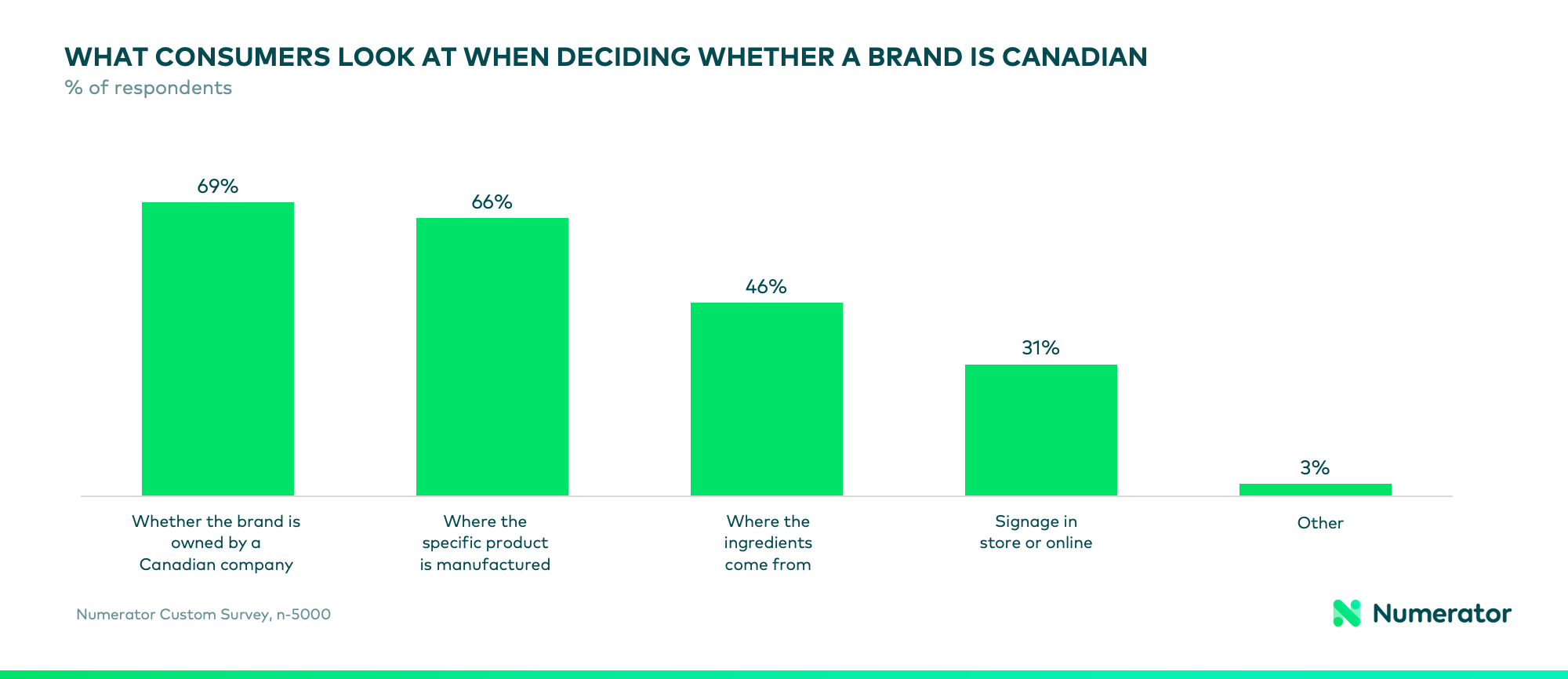

As Canadian consumers explore their options, they aren’t just looking at where products are made—they’re also considering the ownership of the brand itself. Key attributes that influence whether a product or brand is perceived as Canadian include:

- Ownership by a Canadian company: 69% of Canadian consumers cited this as a key factor.

- Where the product is manufactured: 66% pointed to this as a crucial consideration.

- Ingredients sourcing: 46% consider where the ingredients come from when determining a brand’s Canadian identity.

- Signage or labeling: 31% pay attention to visual cues both in-store and online.

These factors present a significant opportunity for brands, both Canadian and non-Canadian, to emphasize aspects of their operations that reflect Canadian values. By showcasing their Canadian roots—whether through ownership, manufacturing location, or ingredient sourcing—brands can better resonate with consumers who are increasingly interested in supporting local products.

Essential vs. Non-Essential: What Are Canadians Willing to Buy Less of?

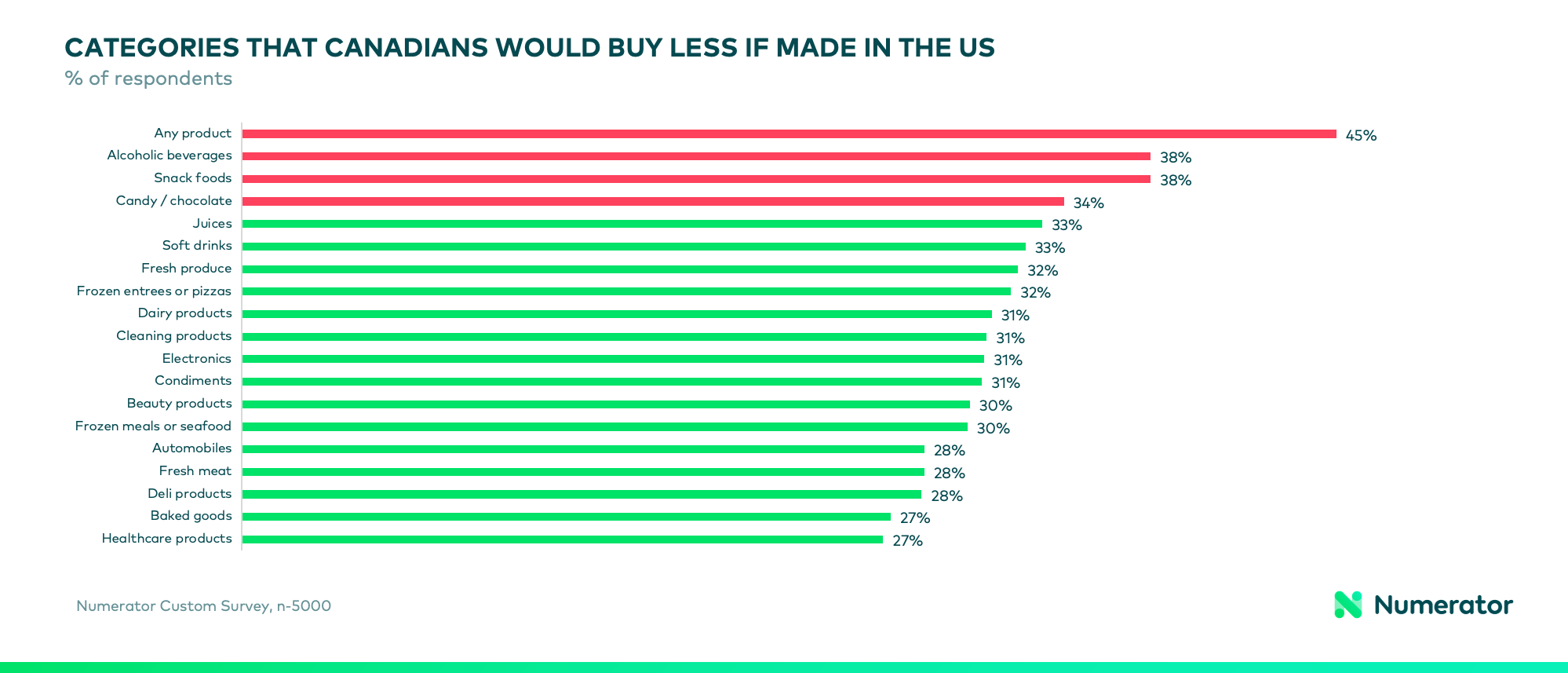

The shift in purchasing priorities is particularly notable in discretionary categories. When asked about products they would consider purchasing less of if they were made in the U.S., many respondents indicated a willingness to cut back on items they might not view as essential. Categories at the highest risk include:

- Candy & Chocolate: 34.1% of Canadian consumers said they’d buy less.

- Snack Foods: 37.7% expressed similar intentions.

- Alcohol Beverages: 37.7% said they’d likely purchase less.

On the other hand, essential products like healthcare items saw a relatively lower level of resistance, with only 27% of consumers indicating they’d reduce purchases if these items were U.S.-made.

U.S.-Owned Retailers: A Growing Issue for Canadian Consumers

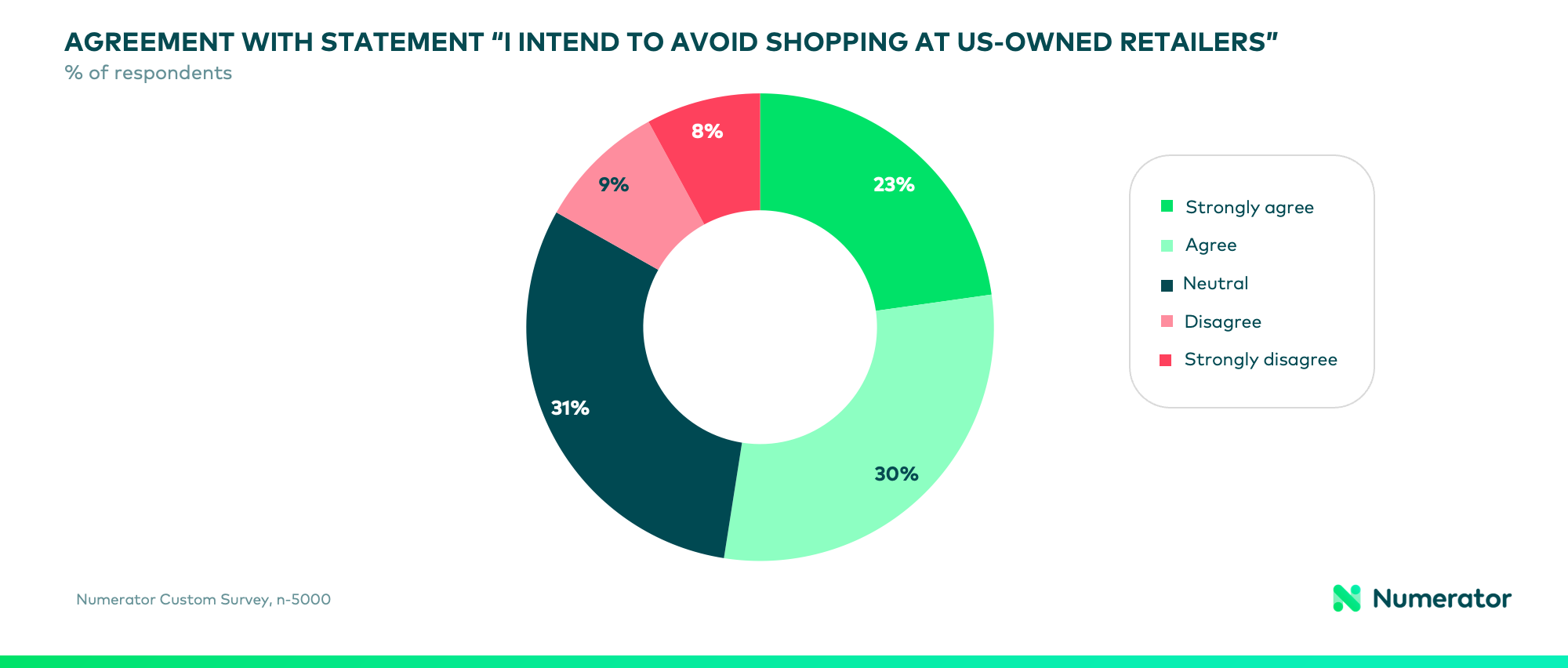

The potential for tariffs extends beyond just product origin—it also impacts where consumers shop. A significant 53% of Canadians indicated they are either very or somewhat likely to avoid shopping at retailers owned by U.S. companies. Even more striking is that 40% of respondents say they would avoid U.S.-owned retailers regardless of whether tariffs are imposed, signaling a patriotic shift that could persist in the long term.

Retailers that are U.S.-owned—or perceived as such—could see a reduction in foot traffic as Canadian consumers shift their preferences. This presents a challenge for U.S.-based retailers but also an opportunity for Canadian brands to build stronger relationships with these consumers, both online and in-store.

What Should Brands and Retailers Do Next?

For brands, particularly those in the Canadian market, it’s crucial to evaluate their exposure to these shifting consumer preferences. Whether you’re a Canadian or an international brand, it’s time to start planning communication and marketing strategies that tap into the growing wave of “buy Canadian” sentiment. Highlighting your Canadian credentials could become a key differentiator in a competitive market.

For retailers, conducting research on how consumers perceive different brands and understanding the factors that influence store choice will be critical. This will help retailers manage their exposure to U.S. brands and identify areas where they can better align with consumer expectations. Moreover, partnerships between brands and retailers could be strengthened by shared insights into consumer behaviour and preferences.

Conclusion

As we continue to monitor the potential impact of tariffs, one thing is clear: these shifts in consumer behaviour are likely to be sticky. Whether tariffs are imposed or not, Canadian consumers appear determined to prioritize supporting homegrown businesses and products. Brands, both Canadian and international, need to stay ahead of this trend by assessing their exposure to these evolving preferences and adjusting their strategies accordingly.

By listening to Canadian consumers and aligning with their values, brands have an opportunity to turn potential challenges into lasting relationships. Numerator can help— get in touch with us today.