Canada Day 2025 took place amidst uncertainty for Canadian consumers: while consumers were increasingly negative about their financial outlook in July 2025 and remain committed to buying on sale or in bulk to cut costs, patriotic purchasing intentions remained high— over half (58%) of Canadian consumers intended to only purchase products made in Canada in July, an increase compared to June. To help Canadian brands and retailers keep pace with the shifting Canadian consumer landscape, we’ve analyzed Numerator’s comprehensive consumer panel data and surveyed verified Canadian consumers to understand how consumers navigated holiday shopping and how patriotic sentiment will impact their shopping behaviour in the future.

Category Shifts Reflect Tighter Wallets

Canadian consumers kept to a tighter budget on Canada Day this year compared to 2024. Compared to Canada Day 2024, buy rate (spend per participating household) dropped 6.8% on July 1, 2025. Households bought 6.2% fewer units, and while spend-per-unit was up slightly (+1.5%), that modest inflation wasn’t enough to offset smaller basket sizes.

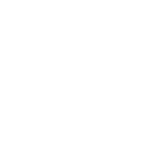

In the lead up to the holiday (June 17 to July 1, 2025), Canadian consumer spending fell 10.1%, driven by a decline in volume as households made 5.5% fewer shopping trips. Significant declines were observed in the buy rate for traditional summer holiday categories, suggesting that households scaled back on holiday indulgences. Alcohol and Snacks, both Canada Day staples, saw double-digit declines in spend per buyer. Meat, Frozen Foods, and Bakery also lost ground, pointing to more modest menus for the long weekend.

Dollar Stores Win Value-Seeking Shoppers

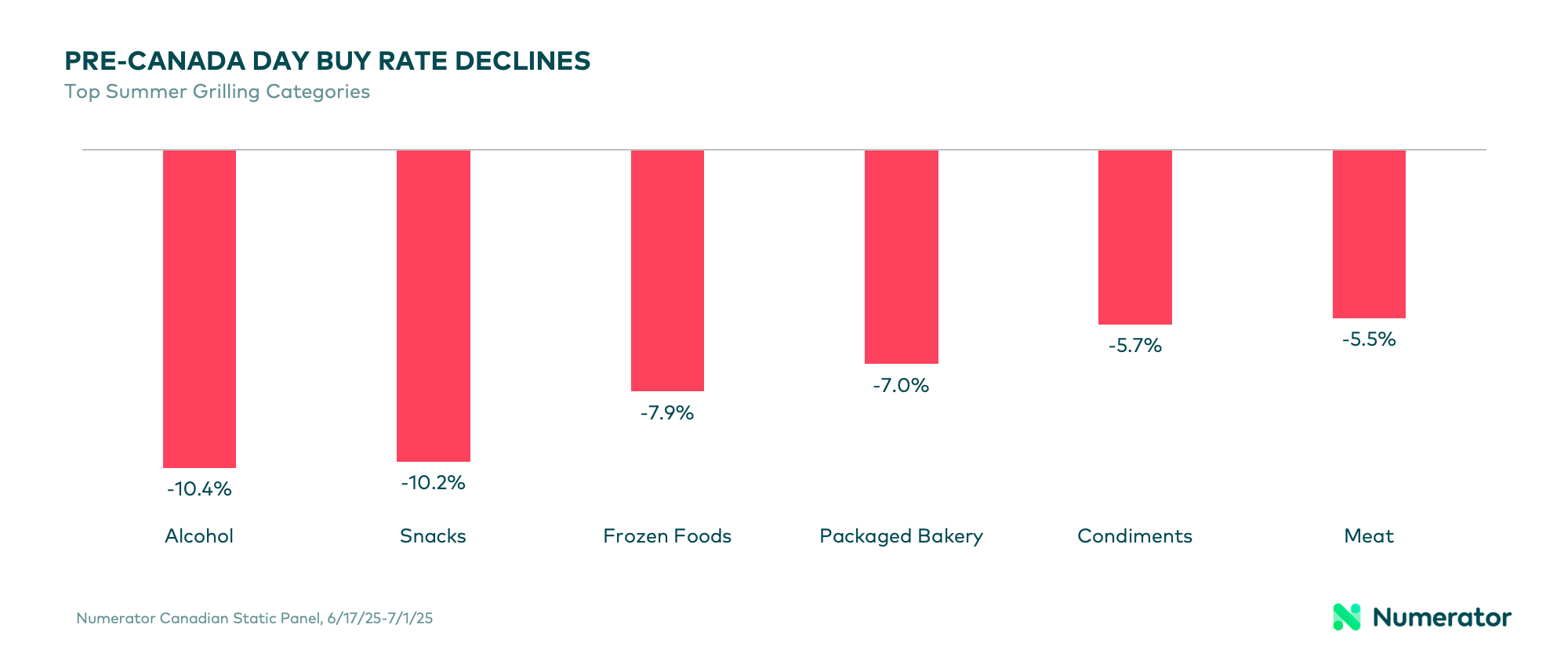

Canadian consumers made conscious shifts at the channel level to minimize their Canada Day spending. Dollar stores gained traction, with household penetration at Dollarama up 5.1%. This growth came largely at the expense of mid-tier and big-box players. Canadian Tire and Amazon, in particular, saw pullbacks in household participation during the two-week lead-in to the holiday.

While the Food channel held steady — likely buoyed by essential purchases — the standout story was Dollarama’s climb up the competitive ranks. The retailer not only captured more trips but leapfrogged some established competitors in household penetration, reinforcing its role as a go-to for affordable Canada Day purchases.

Buy Canadian Sentiment Didn’t Shield Domestic Retailers

Tariff sentiment didn’t fully translate into behaviour. Among Canadians who claimed they would avoid U.S. retailers due to tariffs, actual spending patterns revealed a more nuanced picture. While these consumers did allocate more of their Canada Day budget to domestic retailers, their overall spend dropped more sharply at Canadian banners than at U.S. ones.

Meanwhile, shoppers who didn’t express a preference for avoiding U.S. retailers actually increased their buy rate with U.S. banners, despite reducing spend at Canadian retailers.

National Pride Remains Strong — and Influences Purchase Decisions

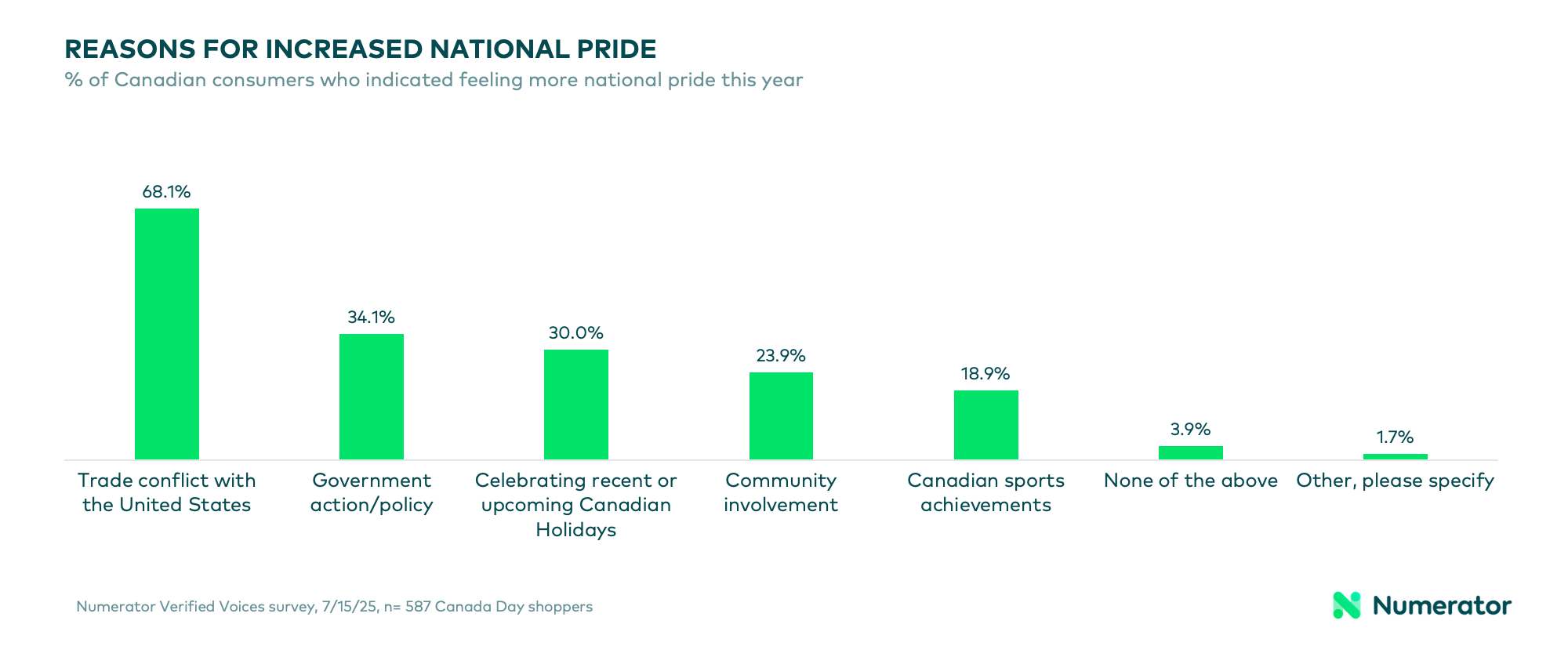

Despite dialed-back spending for the holiday, patriotic sentiment remained high. Over 4 in 5 (89%) Canadians say they are proud to be Canadian, including 62% who are “very proud.” More than half (56%) report their national pride has grown stronger over the past year — driven by factors like the trade conflict with the U.S. (68%), recent or upcoming holidays (30%), and government policies (34%).

This sense of pride translated directly into purchasing behaviour. Canada Day continues to be the most patriotic shopping occasion on the calendar: 62% say they made a Canadian-themed purchase this year, and two-thirds (66%) say they always or often buy Canadian-made products for Canada Day.

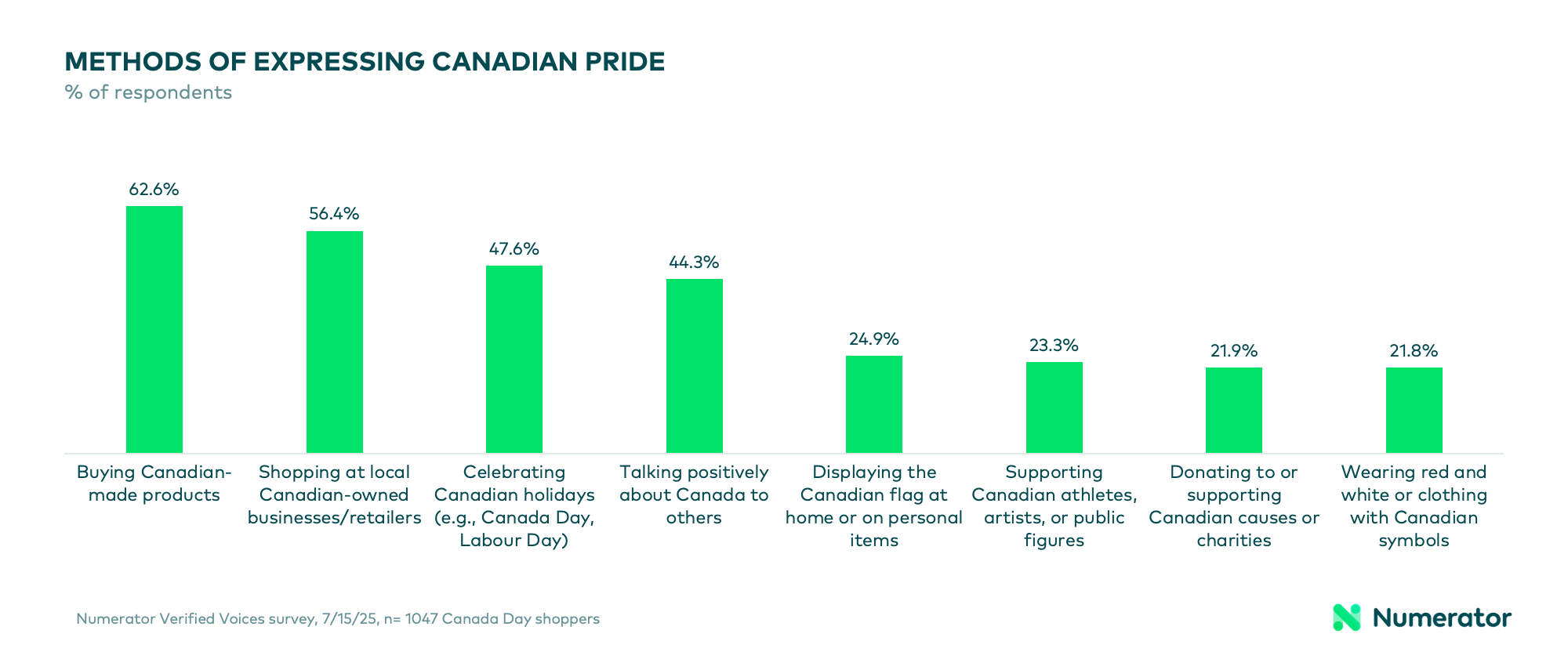

When asked how they most actively express national pride, purchasing choices outranked symbolism or celebration. Buying Canadian-made products (63%) and shopping at local Canadian-owned retailers (56%) topped the list — ahead of displaying the flag (25%) or even celebrating holidays (48%).

Older shoppers (55+) are especially likely to associate holidays with patriotic shopping. Looking ahead, 30% plan to make Canadian-themed purchases for Labour Day and 27% for the August Civic Holiday — lower than Canada Day levels but still reflective of seasonal sentiment.

Food, Bev, and Label Credibility Drive the “Buy Canadian” Movement

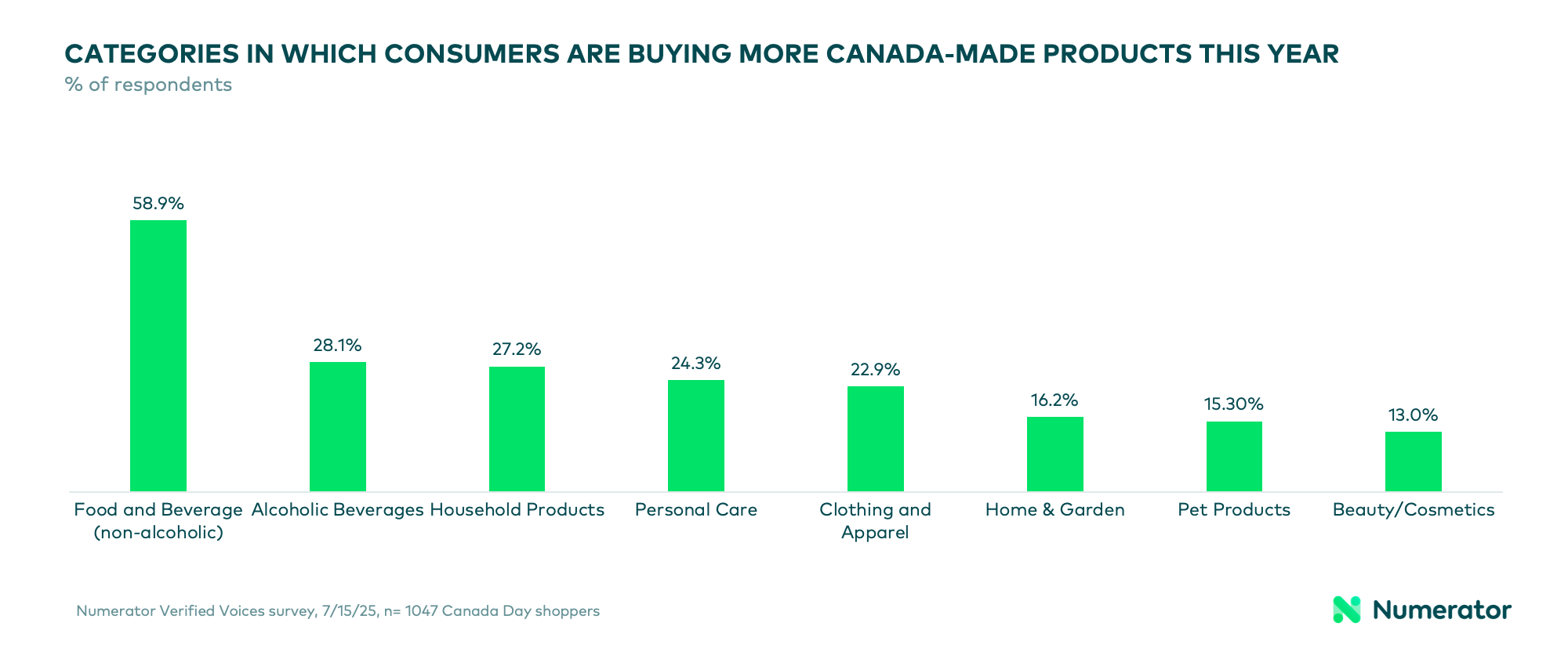

Food and non-alcoholic beverages were most strongly associated with the “Buy Canadian” movement (63%), followed by Alcoholic Beverages (30%) and Household Products (25%). This aligns with recent behaviour: 59% of shoppers say they are buying more Canadian-made food and beverage items than in the past, and 28% are doing the same in Alcoholic Beverages.

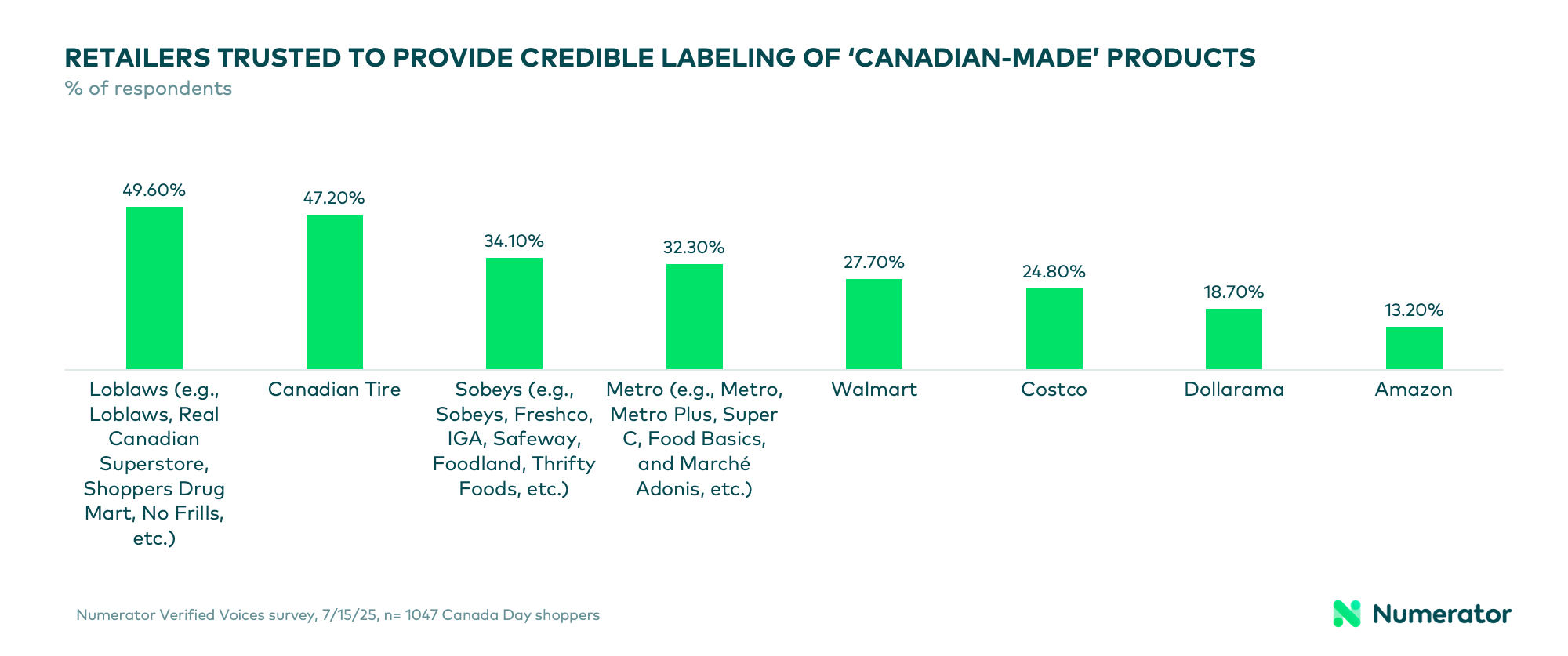

Retailers play a visible role in reinforcing these purchase decisions. Nearly three-quarters (73%) of Canadians say it’s important that retailers they shop at support Canadian-made goods — particularly during national holidays. Loblaws and Canadian Tire are the two retailers most recognized for clearly labeling Canadian-made products, and they are also viewed as the most credible. Over half believe Loblaws clearly labels (56%) and provides trustworthy labeling (50%); Canadian Tire is close behind at 43% and 47%, respectively.

For Canadian Consumers, The Bottom Line is Balancing Patriotism and Pragmatism

Canada Day 2025 highlighted the intersection of consumer trends: national pride (and intent to engage in patriotic shopping) remains strong, but spending decisions continue to reflect economic concern. From food and alcohol to channel shifts and retailer trade-offs, Canadians are balancing patriotic sentiment with a need for value.

Retailers that clearly and consistently promote Canadian-made goods stand to benefit, especially around key national moments. Canadian brands can educate retail partners on their verified customers’ sentiment, from Buy Canadian intentions to overall economic concern, and how that impacts their shopping behaviour across channels, retailers, and categories.

As Canadian consumers— and brands and retailers— navigate ongoing economic and political uncertainty, deeply understanding your consumers, their purchase behaviour, and the why behind that behaviour will be key to developing new growth strategies. Numerator can help. Reach out to us today to get started.