The COVID-19 vaccine rollout in Canada has steadily gained steam after a slow start. As of May 17th, the country is close to surpassing the United States in initial doses with 46% of Canadians having received their first shot. As consumers contemplate a post-pandemic future, will the vaccine also inject them with the confidence to return to their pre-COVID shopping ways?

To get some answers, Numerator recently checked the temperature of consumer sentiment around the vaccine and revealed the results in our latest webinar. Digging into our Vaccine Premium People Groups and data from our Sentiment and Holiday Intentions Surveys, we analyzed how consumers’ desire to get the vaccine is impacting their post-COVID perspectives and plans. From demographic differences to holiday celebrations, we take a look at whether the vaccine is offering shoppers a sense of security as they prepare for reopening and a return to normal.

To Vaccinate or Not to Vaccinate: The Difference is in the Demographic

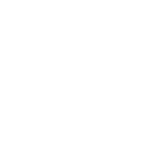

Our Vaccine Microsurvey found that as of April 2nd, almost 60% of Canadian consumers intend to get vaccinated, roughly 20% are unsure, and 10% say they won’t get it.

Delving deeper into the demographics, we find that interest in getting the vaccine increases with age and varies by ethnicity. Consumers who want the vaccine tend to be older, understandable given these age groups are more vulnerable, and are also predominantly White or European. Meanwhile, Millennial and Gen Z shoppers are the most hesitant or unlikely to get vaccinated. Uncertainty and avoidance is higher among Black and Arab households as well.

The Influence of Inoculations on Shopping Behaviour

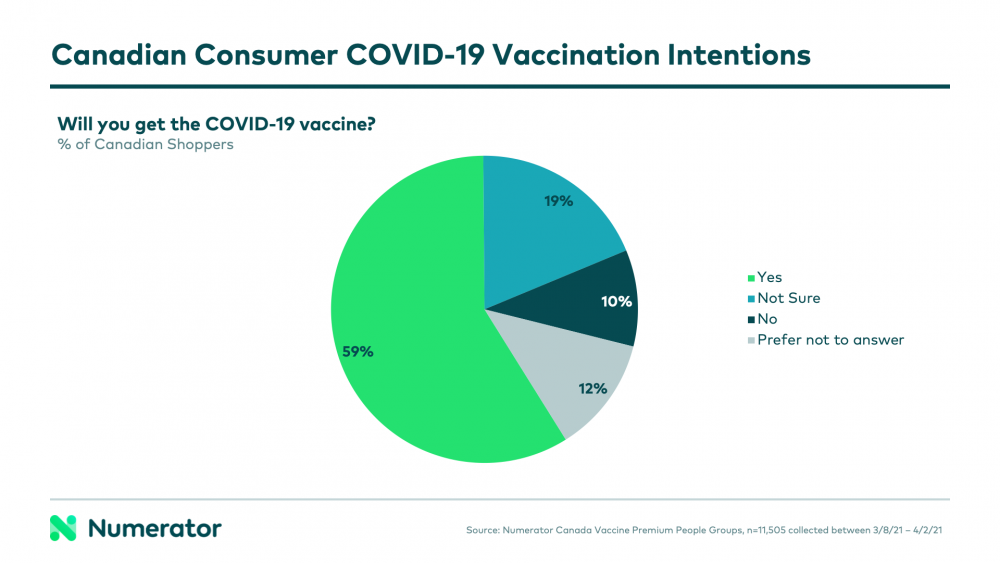

Shopping trips took a dramatic dip across all consumer groups as soon as the pandemic began. While trips remain below the pre-COVID average, fewer trips has led to an overall increase in basket size and spend on FMCG products among consumers. However, when we connect the data dots between shopping behaviour and vaccine sentiment, we start to notice some distinct differences.

Vaccine seekers reduced their trips the most, but their spending on FMCG products increased the least. These consumers also prefer more conventional grocery channels, which could be due to the perceived safety of these stores. In contrast, vaccine avoiders reduced their trips the least, but tended to stock up on FMCG products the most and are more likely to shop at Mass, Dollar, and Convenience channels.

A Return to Normal Needs More Than a Shot in the Arm

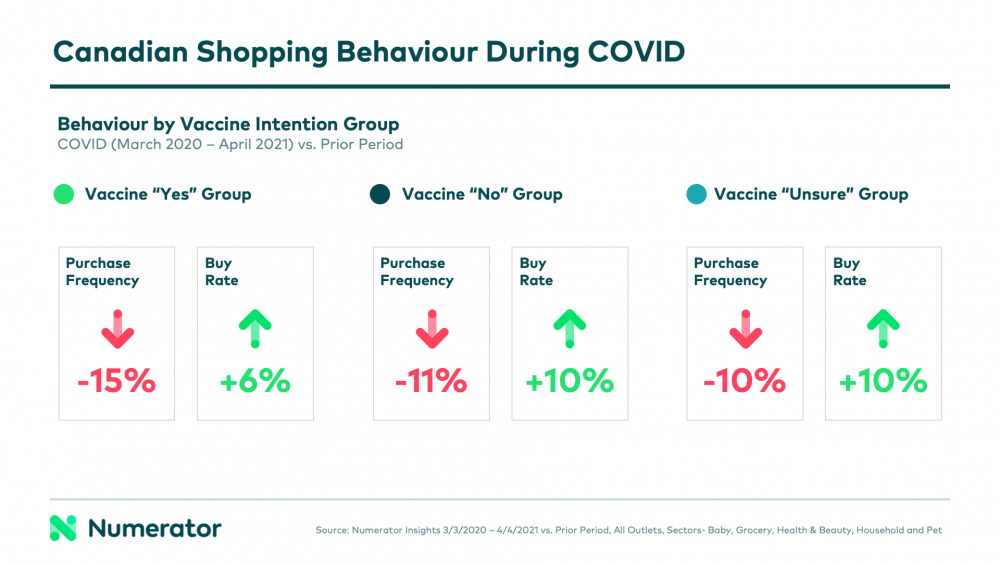

Optimism is in the air for many Canadian consumers, but caution remains the name of the game. Results from our most recent Sentiment Survey indicate that hope runs highest among consumers planning to get vaccinated. Almost 60% of these consumers look forward to a return to normal by the end of the year, though for now they’re still playing it safe. On the other hand, despite being less optimistic, the 10% of consumers choosing not to vaccinate say they’re already back to normal and participating in activities they enjoyed pre-COVID.

Besides vaccination, what factors will trigger a return to regular life for consumers? Most shoppers are seeking guidance from health experts and government authorities as well as waiting for the number of cases to drop. Consumers not getting the vaccine are on the lookout for the remaining restrictions and mask requirements to be removed.

COVID Concerns Keep Holidays Celebrations on Hold

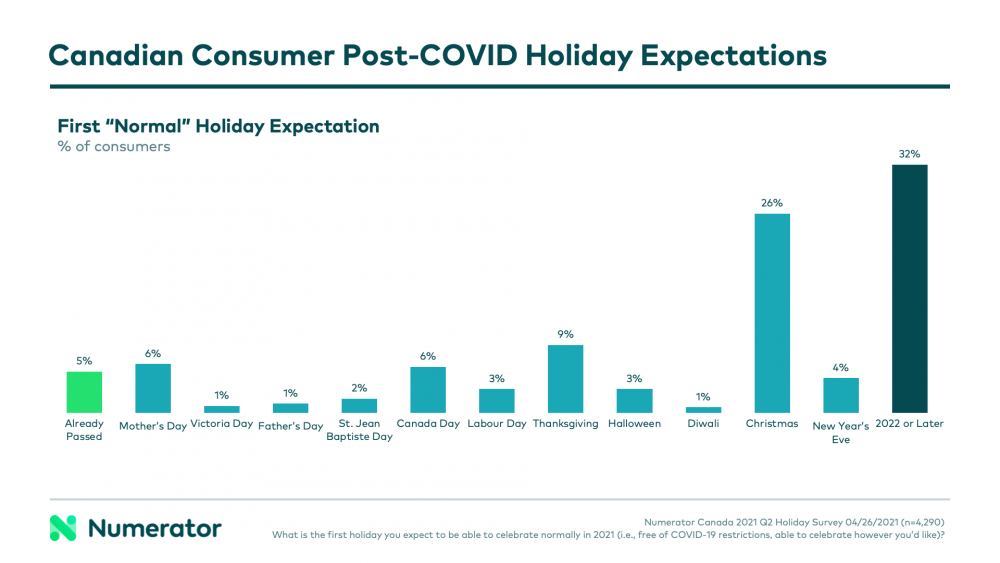

In the short-term, cautious consumers will continue to keep their holiday celebrations subdued. Based on our Holiday Intentions Survey, more than half of consumers expect their upcoming holidays to be significantly impacted by COVID, especially those that involve larger gatherings. In fact, fewer than 50% of consumers believe holiday celebrations will be normal before Christmas and one-third don’t see them being back on track until 2022.

The good news is, even with some lingering concerns, most consumers (58%) are looking forward to the future and are excited to celebrate being together with friends and family again after so much time apart.

Looking Ahead

Vaccinations will play an important role in shoppers returning to normal, but they’re not the only factor. Brands and retailers should plan for a slow transition, knowing that many Canadian consumers are proceeding with care and awaiting input from health authorities as well as the easing of any remaining restrictions. That said, we expect vaccinated shoppers to be the primary drivers of shifts in shopping behaviour as their post-COVID comfort level grows.

We invite you to listen to our webinar replay for additional details on how consumer sentiment around the COVID vaccine is affecting attitudes and shopping patterns. Our goal is to always provide our brands and retailers with the most up-to-date information so you can make the right decisions as you guide your business through this unusual time.

To learn more about leveraging our Vaccine Premium People Groups or how your brand or category is affected by post-vaccine behaviour, please contact your Numerator Customer Success Consultants or get in touch with us.