For now, a trade war between the United States and Canada appears to be on hold, after US President Donald Trump and Canadian PM Justin Trudeau reached an agreement to delay the Trump administration’s planned 25% tariff on imports from Canada for at least a month. The Numerator team has surveyed over six hundred Canadian consumers to offer a look at how tariffs may impact Canadian consumers, who have already been reacting to inflation by decreasing their spend across traditional FMCG categories.

Tariffs on Canadian Goods: Consumer Sentiment

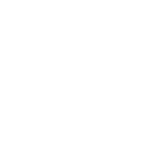

The overwhelming majority of Canadian consumers (71.4%) are worried about the possibility of the United States imposing tariffs on Canadian goods. Almost 2 in 5 (39.5%) consumers are very concerned, while 3 in 10 (31.9%) are somewhat concerned. Trade policy and the potential economic impact are clearly top of mind for Canadian consumers— only 8.8% remain unconcerned about the potential consequences of US tariffs on Canadian goods.

The level of concern among consumers varies significantly across different purchase power brackets. Affluent consumers, who have the highest purchasing power, are the most concerned, with almost 3 in 4 (74.8%) expressing anxiety over potential U.S. tariffs. In contrast, consumers with the lowest purchasing power are slightly less concerned, though a majority (65.5%) are worried.

Concerns over Canadian Tariffs on U.S. Goods

Canadian consumers are also concerned over the possibility of retaliatory tariffs on U.S.-made goods. Over half (57.7%) express some level of concern about Canada imposing tariffs on products from the U.S., though the level of concern is lower than concern over U.S.-imposed tariffs. Among these consumers, 1 in 4 (25.6%) are very concerned, and 1 in 3 (32.1%) are somewhat concerned. Only slightly more than 1 in 10 (13.1%) consumers are unconcerned.

Mirroring U.S. tariff fears, affluent consumers are the most likely to express concern over Canadian tariffs, with 63.8% of this group worried over the impact of Canadian tariffs on U.S.-made goods. Middle and low-income consumers are somewhat less concerned, with more than half (56.6% and 52.6%, respectively), expressing concern. Despite the lower level of concern, it’s clear that Canadian consumers remain uneasy over escalating trade tensions.

Changes in Shopping Behaviour

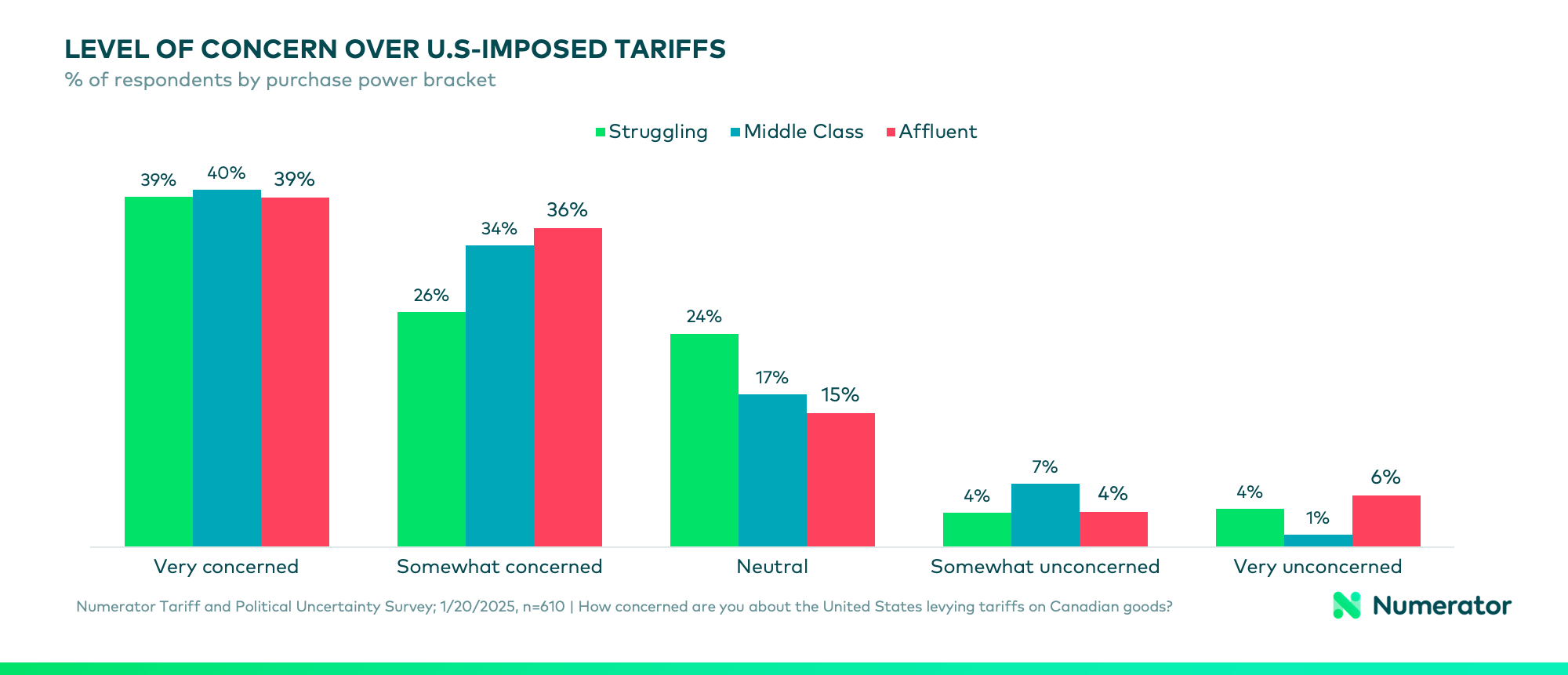

Despite the high levels of concern over tariff news, most Canadian consumers have maintained their usual shopping habits. Over 7 in 10 (77.3%) have not altered their purchasing behaviour since the U.S. presidential election in anticipation of tariffs. However, the remaining 17.9% who have changed their behaviour are making more strategic decisions about their spending.

Among those who have changed their behaviour, cutting back on non-essential purchases is the most common action (52.7%). Other common responses include purchasing cheaper essential goods (47.3%) and budgeting expenses (45.5%). In addition, 25.9% of these consumers have chosen to stock up on products they expect to be impacted by tariffs, while 18.8% have bought products earlier than they otherwise would have.

Differences in Behaviour Shifts by Income Level

The type of behaviour change varies depending on a consumer’s purchasing power. Consumers with lower purchasing power are most likely to have cut back on non-essential purchases (48.2%) and purchased cheaper essential goods (48.2%), changes that may reflect a need to prioritize essential spending while minimizing costs.

On the other hand, affluent consumers, who have the financial flexibility to adjust their spending in different ways, are more likely to delay vacations or trips and reduce or cancel subscriptions. Middle-income consumers, in particular, tend to focus on cutting back on non-essential purchases (67.6%) and budgeting expenses (55.9%), suggesting a more cautious approach to discretionary spending.

Future Spending Plans: A Leaner Approach

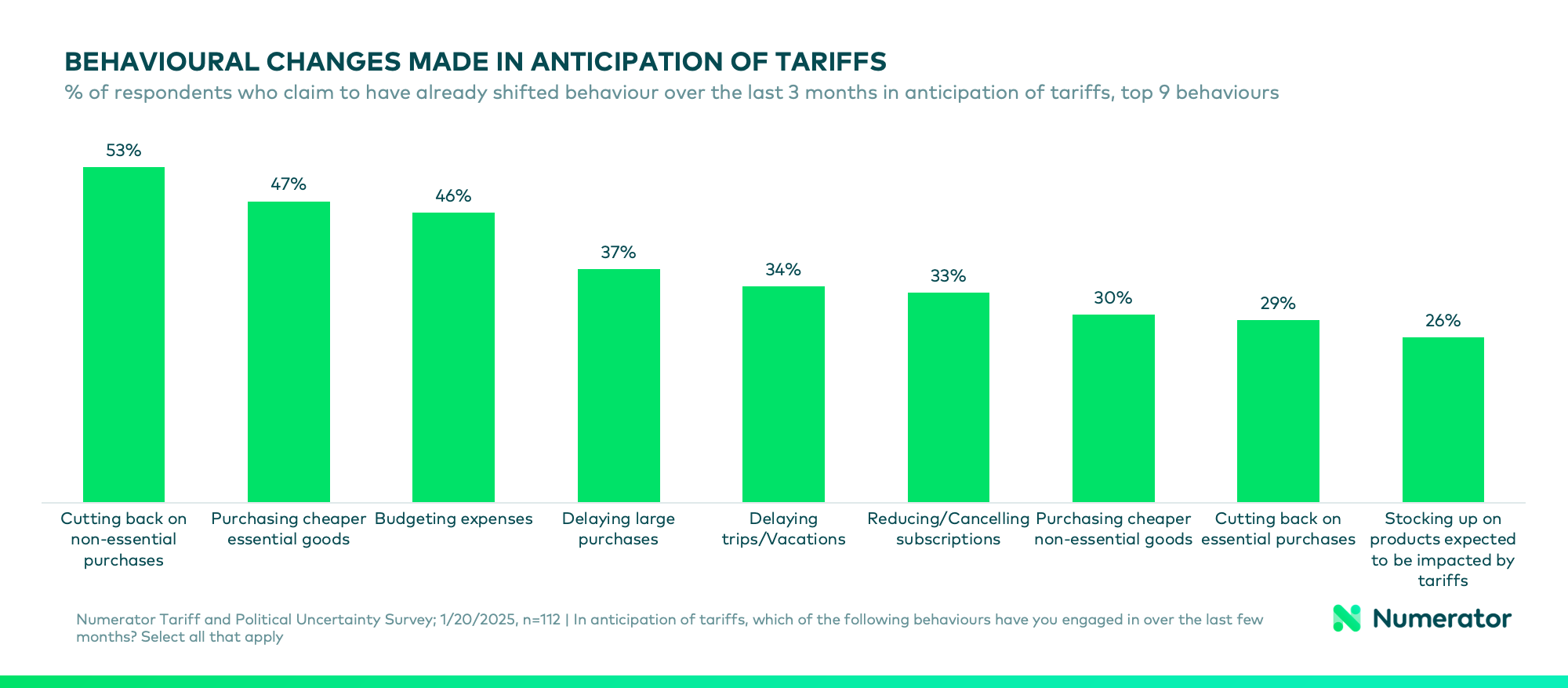

Looking ahead, the prospect of tariffs between Canada and the U.S. has already led many consumers to plan for a reduction in their future spending. Over two-thirds of Canadian consumers (68.5%) say they plan to cut back on spending if tariffs are imposed.

The areas most likely to see reduced spending include travel (49%), bars and restaurants (49%), apparel (43%), and entertainment (43%). These categories reflect consumers’ intent to prioritize essential purchases while limiting expenditures on discretionary items.

Middle purchasing power consumers are the most likely to plan to cut back on spending (71%), followed by high purchasing power consumers (67.6%) and low purchasing power consumers (67%). Despite differences in income level, the general sentiment across all consumer segments is clear: a reduction in spending is expected if tariffs become a reality.

Conclusion

As Canadian consumers brace for the potential impact of tariffs, it’s evident that trade policy and economic uncertainty are top concerns. While the majority of Canadians have yet to alter their shopping behaviour, a significant portion is already making changes to their purchasing patterns. Looking ahead, consumers—particularly those in the middle and lower income brackets—are preparing to tighten their budgets in anticipation of potential price increases, especially in non-essential categories.

For businesses, understanding these shifting concerns and behaviours is crucial for adapting to the changing landscape and anticipating consumer demand. Numerator is here to support Canadian businesses with visibility into near real-time Canadian shopping behaviour and fast, flexible surveys to quickly get a pulse on Canadian consumer sentiment. Reach out to your Numerator team or get in touch to start planning your tariffs strategy.

Numerator Canada’s upcoming webinar, Tariffs, Turbulence, and Tight Budgets: Checking in on the Canadian Consumer in 2025, will provide an in-depth check-in on the Canadian consumer and providing actionable insights for Canadian business owners, including a deeper look into our tariff analysis on Wednesday, February 12 at 11 AM ET. Register for the webinar here.