To help support our clients during the Coronavirus (COVID-19) outbreak, Numerator will provide ongoing analysis into consumer behaviour and sentiment by conducting ongoing surveys of verified buyers. In addition to our standard US consumer insights, we have expanded our North American footprint to bring critical insights to the Canadian market leveraging our Canadian OmniPanel.

We will continue to keep all prior iterations of these survey insights available on our website. This is the latest round of data, collected in a survey fielded through 7/28 to Numerator’s Canadian OmniPanel.

Across Canada, some regions have begun easing COVID-19 restrictions and moving into the early phases of their reopening plans, which has led to a slight increase in cases in some regions. In this latest iteration of our consumer sentiment survey, we saw an increase in COVID-19’s impact on shopping behaviour and the level of concern consumers have regarding the virus. We also asked consumers how they felt about phased reopening plans, what types of activities they are likely to participate in in the coming weeks, and what their thoughts are on various precautions retailers are taking.

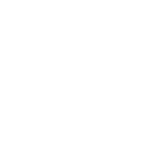

COVID-19 impact on consumer behaviour up slightly

This week, 84% of Canadian consumers said their shopping behaviour had been impacted by Coronavirus, up slightly from last month’s survey, but still lower than US levels. Given ongoing uncertainties, supply chain disruptions, and risks of potential resurgences in cases, it is likely we will continue to see fairly elevated levels of impact and occasional increases before we see a full return to normal.

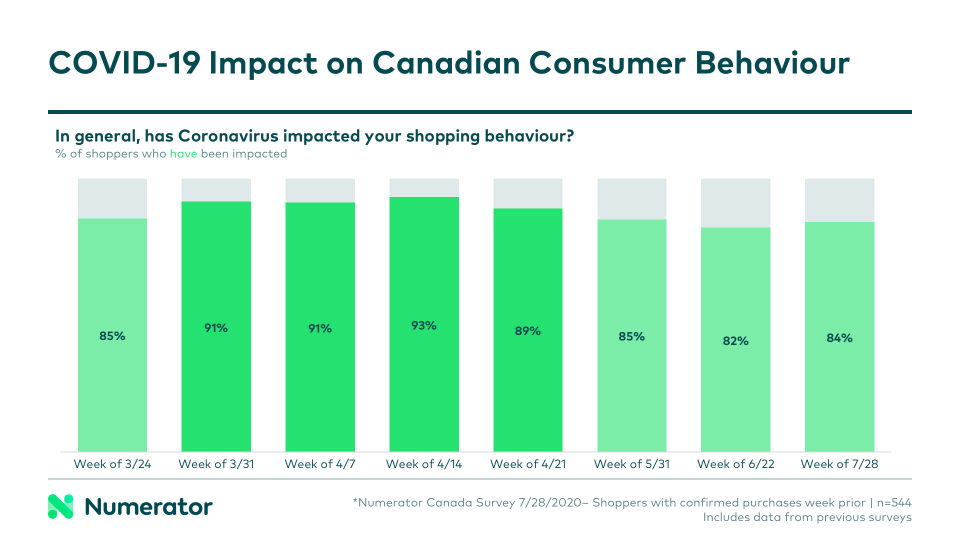

Many shopping habits continue slow return to pre-COVID norms

For the second month in a row, many of the shopping impacts we’ve seen as a result of COVID-19 were down significantly in July. This is expected, given the widespread reopening of many non-essential stores and businesses, and we anticipate continued declines as regions progress through their phased reopenings. The number of consumers facing store closures decreased dramatically from 32% last month to only 17% this month. Despite in-store reopenings, online shopping remained elevated, with more than one in three consumers opting for online orders in lieu of in-store trips.

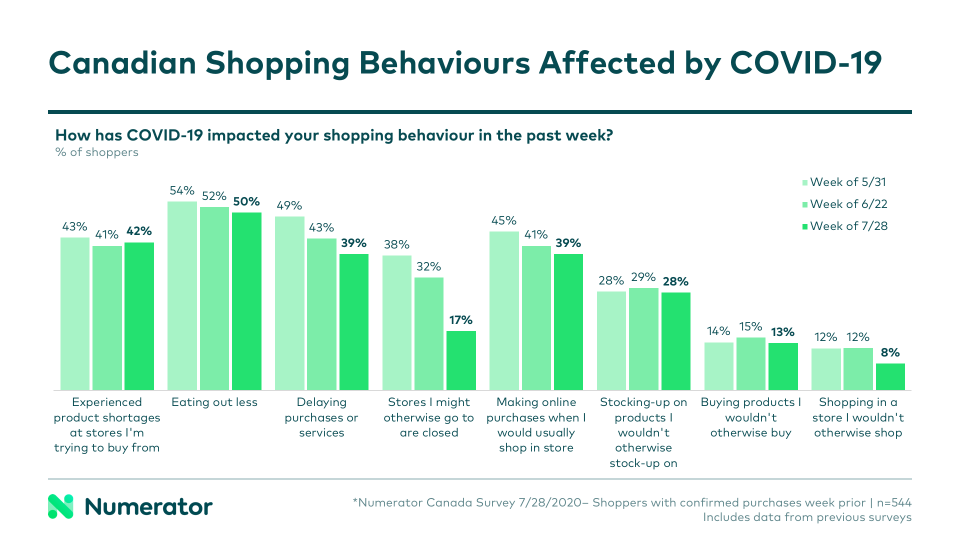

Consumers embrace non-essential activities as regions reopen

Compared to last month’s survey results, Canadian consumers have increased their likelihoods of participating in a variety of non-essential or previously limited activities. The activities seeing the greatest increases are resuming personal grooming services and dining in at a restaurant. As we ease into the reopening process, businesses should expect a slow return to any out-of-home social activities and behaviours, particularly those that are indoors.

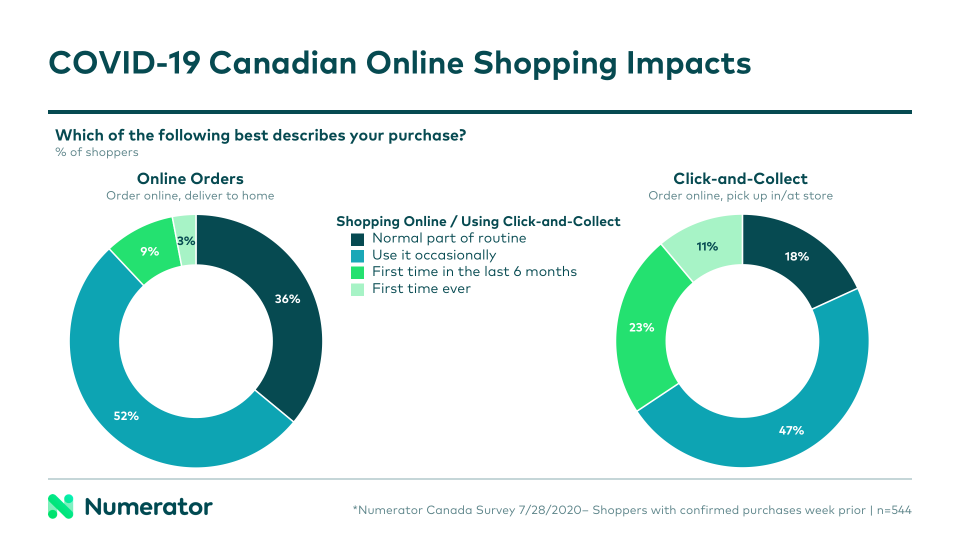

Online delivery and click-and-collect services continue to attract new users

Two-thirds of Canadian consumers surveyed said they had placed an online delivery (ship-to-home) order in recent weeks, and nearly half said they had placed an online order for pick-up (click-and-collect).

12% of those who placed an online ship-to-home order indicated it was their first time ever or first time in the past six months doing so; 34% of click-and-collect users said the same. These numbers of new shoppers for online services are a bit higher than what we’ve seen in the US, where 10% of ship-to-home shoppers and 25% of click-and-collect shoppers are new or new lately. COVID-19 has brought about a drastic shift towards online shopping, particularly among Canadian shoppers who had previously been more hesitant to adopt these services. Retailers must continue to prioritize and invest in these delivery and click-and-collect options.

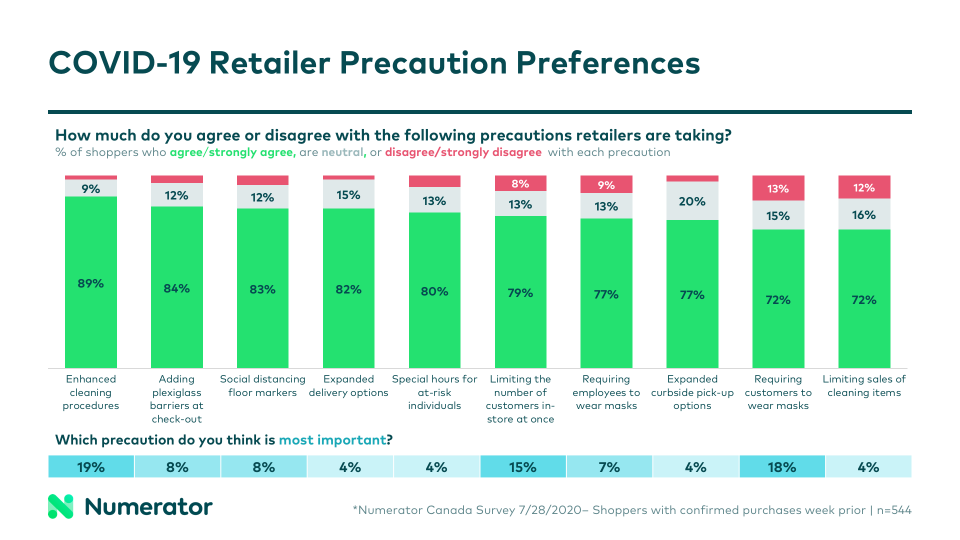

In-Store shoppers are supportive of most retailer precautionary measures

Consumers were supportive of most precautionary measures being taken by retailers to slow the spread of COVID-19 inside their stores. The most widely supported measure was enhanced cleaning procedures, which was also the precaution consumers rated as most important overall. Other precautions consumers found most important were requiring customers to wear masks and limiting the number of individuals in the store at once. Mask requirements were also the measure that saw the most backlash, with 13% of consumers disagreeing with retailers’ requirements.

As a whole, every precaution garnered support from at least 72% of consumers, and retailers were more likely to attract consumers than to lose them as a result of enforcement. 40% of consumers said they preferred shopping at retailers with strict precautions in place, and 27% said they would go out of their way to shop at retailers with such precautions. Comparatively, 6% said they preferred retailers without strict precautions, and only 4% said they’d go out of their way to shop at retailers without these precautions.

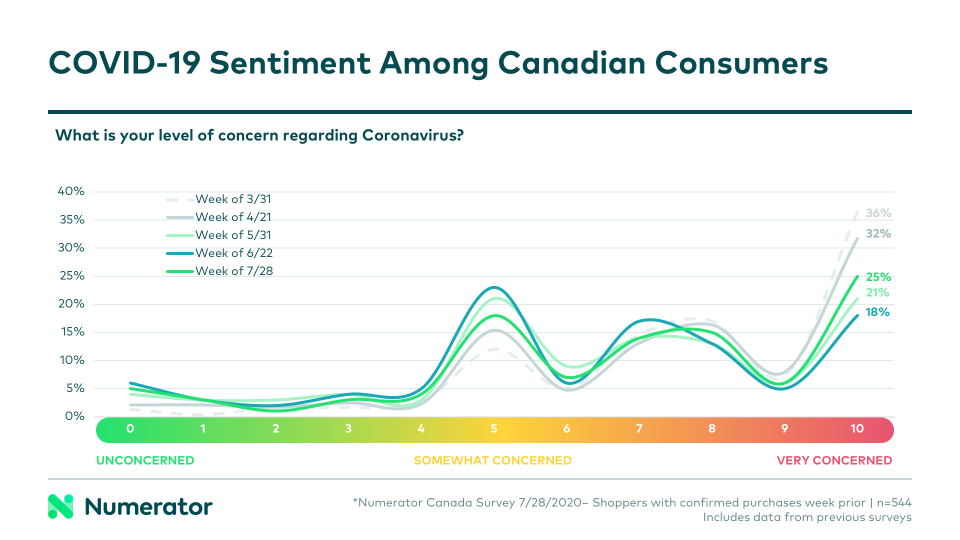

Concern over Coronavirus on the rise

80% of Canadian consumers said their regions had entered at least Phase 1 of a reopening plan, which allows some non-essential businesses to reopen their doors. Attitudes surrounding reopening were split— 54% believed their region was reopening at the right pace, 33% thought it was moving too quickly, and 13% believed reopening was overdue. This varies considerably from US consumers, who were more likely to think opening was overdue, despite the fact that more US regions are open.

The majority (45%) of these individuals said the reopening had not changed their level of concern regarding the virus, but many (40%) said their concerns had increased slightly as their regions began reopening. The overall level of concern rose significantly this month as well, with 25% rating themselves as “very concerned (10/10)” about Coronavirus, up from 18% last month. After a couple months of decline, concern seems to be rising alongside new case numbers, a trend we’re seeing in the US as well.

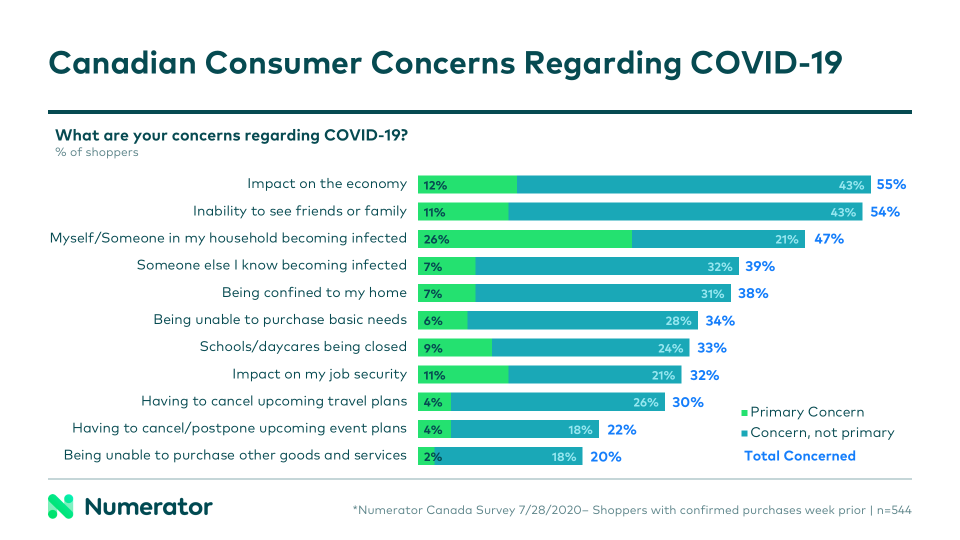

Impact on economy rises to top concern among Canadian consumers

More than half of Canadian consumers are concerned about the economic impacts of COVID-19. Inability to see friends and family was a close second, followed by the risk of becoming infected.

Looking Ahead

Given the fast-changing nature of the outbreak, we anticipate continued fluctuations in behaviour, impact and levels of concern in the coming weeks. As seen recently, even the lifting of stay-at-home orders will not be a quick-fix for businesses or consumers, but rather will initiate a slow return to a new normal. Now more than ever, it will be important to monitor consumer behaviour and sentiment in order to navigate reopening communities and adjusting to this new normal.

Numerator will be closely monitoring the situation to ensure brands and retailers have the most up-to-date information on consumer behaviour. For more information on how your brand or category is affected by COVID-19— in Canada or in the United States— please get in touch with us.