A new era of Canadian consumer behaviour is here— and it’s arriving faster than you think.

Many Canadian brands and retailers see GLP-1s as a passing fad that will have limited long-term influence on how Canadian consumers shop and eat. Emerging verified purchase data suggests the opposite.

In the U.S., GLP-1 adoption has expanded rapidly over the last three years, measurably altering grocery spending, trip frequency, and category-level behaviour. Canada is earlier along in this journey, but the conditions for accelerated adoption are now in place: the global GLP-1 supply shortage has resolved, Canadian insurers are expanding coverage, and generic versions could enter the market as early as January 2026 upon the expiration of Novo Nordisk’s Canadian patent. Government estimates already place GLP-1 usage at over 1.5 million Canadians.

The implications extend well beyond health and wellness. GLP-1s fundamentally alter how consumers experience food by reducing appetite and cravings and slowing food digestion. These biological shifts translate directly into behavioural changes, especially across food and beverage categories. For brands and retailers, understanding how the GLP-1 consumer shops will be crucial.

Below, we break down Numerator’s ongoing Canadian GLP-1 study, our years-long research on GLP-1 medications in the United States, and what these findings mean for your business.

What can Canadian brands and retailers learn from the United States, a more advanced GLP-1 market?

Because the U.S. is further ahead on GLP-1 availability and insurance coverage, Numerator’s GLP-1 solutions have been available to analyze how these medications reshape everyday purchasing since 2023. As Numerator’s Chief Economist Dr. Leo Feller explains, GLP-1s represent a unique moment where individual medical choices drive macroeconomic change: when millions of consumers feel full faster, snack less, and reduce trip frequency, it affects entire categories.

Nearly one in five (18.1%) of U.S. households now have a GLP-1 user, and GLP-1 awareness has risen sharply, with only 12.8% of U.S. consumers unaware of these medications. Importantly, the composition of the user base is shifting. While early adopters primarily treated diabetes, recent growth is driven by weight-loss users, often higher income and more urban. These higher income and urban households tend to have greater access to supermarkets with healthy options, allowing them to shift more aggressively toward nutrient-dense foods.

Across GLP-1 households, Numerator observes an average 5% decline in total grocery spend after several months on the medication. The category impacts follow consistent logic: more indulgent options, such as chips, cookies, sweet bakery goods, frozen sides, bacon, and meat categories, have experienced noticeable declines due to decreased cravings or smaller portions, while categories like yogurt, meat snacks, and fresh fruit are holding or growing.

Spending partially rebounds after consumers lapse from GLP-1 medications but does not return to baseline, suggesting that behavioural change is driven more by biology than willpower. Lapsing is common, often due to cost, side effects, insurance changes, or achieving a weight-loss goal.

Although these shifts sound disruptive, current GLP-1 penetration means category-wide impact remains modest. The larger strategic shift lies in future GLP-1 adoption, especially as lower-cost or pill-based alternatives emerge in both the U.S. and Canadian markets.

What are the early signs of GLP-1 impact in the Canadian market?

Canada is in the early stages of its GLP-1 adoption curve, but the behavioural signals already mirror those seen in the U.S. According to an analysis shared by Numerator Sr. Analyst Sid Sarin, several structural factors position Canada for a significant leap in adoption: stabilized supply, expanded insurance eligibility, and the possibility of widely available generic GLP-1 medications in 2026.

Numerator’s Canadian panel shows that 13% of Canadian households already have a GLP-1 user—a sizable portion, and not far behind U.S. levels. Current users tend to skew older and lower income, reflecting the drug’s initial purpose as a diabetes treatment. The weight-loss cohort skews higher income, suggesting the demographic profile of GLP-1 users will shift as cosmetic or lifestyle-driven usage expands.

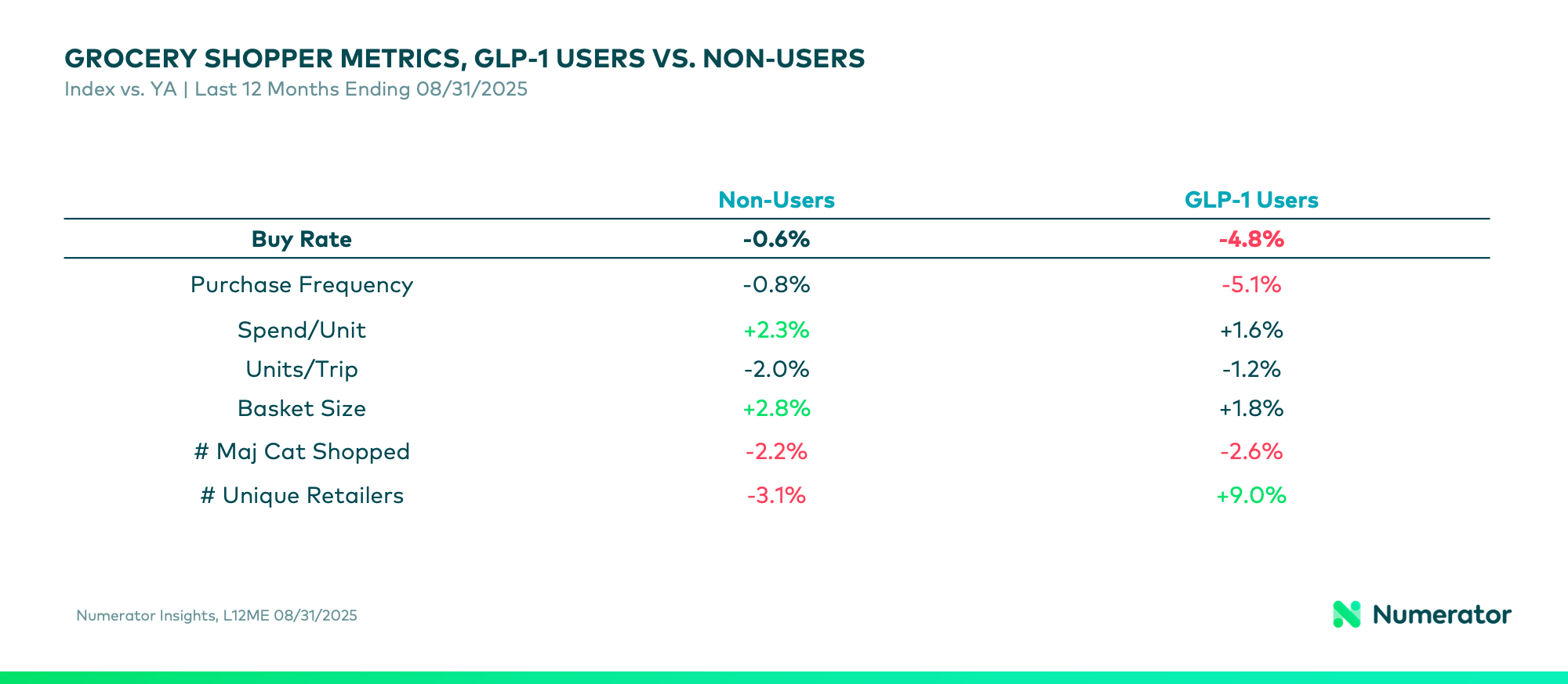

Even at this early stage in Canada, the pullback in consumption is noticeable. Canadian GLP-1 households have reduced overall grocery spend by 4.8% versus non-users, who reduced their spend by 0.6%. The primary driver is trip frequency: GLP-1 users shop less often, purchase fewer units per trip, and spend more per unit.

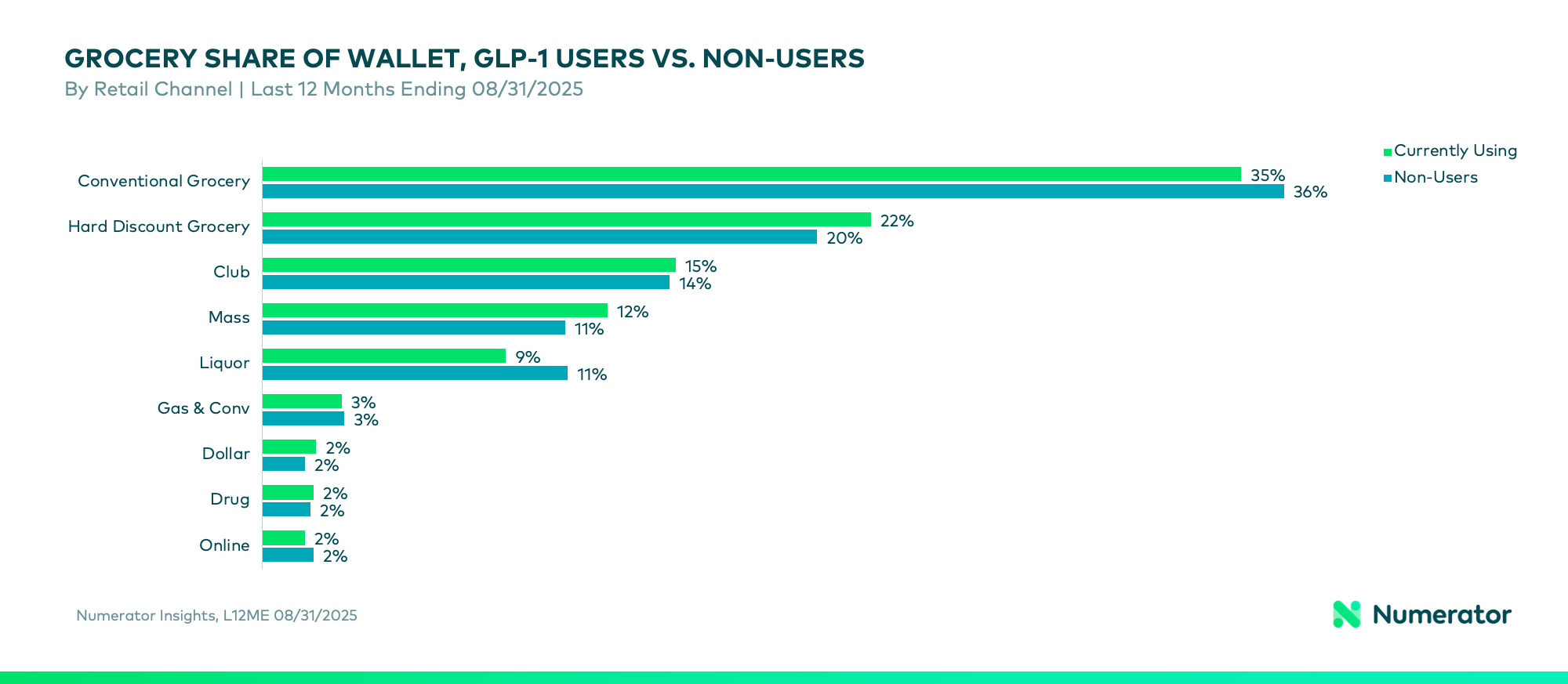

As in the U.S., weight-loss users show sharper declines in consumption than diabetes users. Category patterns are also beginning to diverge. Snacks are an early indicator: GLP-1 users’ spending is down ~7% year-over-year, compared to a ~1% decline among non-users. Retail channel preferences are also shifting: GLP-1 households over-index to the Hard Discount, Mass, and Dollar channels. This retail shift points to evolving trip missions— leaner baskets, more functional shopping, and possibly new banner loyalties as adoption expands.

How can Canadian brands and retailers navigate the evolving impacts of GLP-1 drugs on their consumers and the market?

To help brands and retailers understand these shifts, Numerator has launched GLP-1 Premium People Groups, refreshed quarterly. These segments include current users (with weight-loss vs. diabetes distinctions), lapsed users, and potential users, with a distinction between recent and long-term adopters. Because membership in these groups is tied to each panelist’s verified receipt data, brands can see exactly how GLP-1 usage alters each panelist’s category purchase behaviour, brand preference, and channel choices.

What are the strategic implications for Canadian brands and retailers?

Category-level risk will vary widely. Early pullbacks are most significant in more indulgent categories, while nutrient-dense categories may remain stable or grow. But even within declining categories, brand-level performance will diverge depending on how well products align with smaller portion sizes, functional nutrition priorities, and a shift to reduced cravings. Understanding category- and brand-level exposure to GLP-1 households will be essential as adoption accelerates.

Functional and nutrient-dense offerings may gain ground. Yogurt, meat snacks, fresh fruit, and protein-rich or satiety-oriented foods may benefit as Canadian consumer preferences shift.

Retailers will need to adapt to fewer—and different—trips. With GLP-1 users shopping less often and gravitating toward Hard Discount, Mass, and Dollar channels, retailers should rethink trip missions, consider merchandising shifts, and reassess high-value categories for GLP-1 households.

Segmentation will become a competitive advantage. GLP-1 usage is just one facet: the consumer behaviour of a GLP-1 user will differ meaningfully by use case, duration, income level, and broader demographic and attitudinal attributes. Brands that rely on aggregate trends will miss critical nuances among GLP-1 households; brands that segment effectively will stay ahead.

Plan now for the next adoption wave. The most significant Canadian shifts are already occurring, as generics are poised to lower costs, advertising of GLP-1 medications like Wegovy grows, and coverage expands to include weight loss. The brands preparing today will be the ones positioned to capture tomorrow’s demand.

How can Numerator help?

Numerator provides the data foundation Canadian businesses need to move from uncertainty to action:

- GLP-1 Premium People Groups: Apply dynamic, regularly refreshed segmentations (linked to verified purchase behaviour) to your ongoing reporting and custom analyses in Numerator Insights.

- Category and Brand Diagnostics: Identify GLP-1 household exposure, quantify trip and unit drivers, and pinpoint which cohorts drive declines or growth. Understand both current and future GLP-1 risk across your portfolio.

- Custom Surveys: Understand and track motivations, future intent, and say-do gaps among GLP-1 users who are also verified buyers of your brand or category.

If you’d like to explore the value of our GLP-1 Premium People Groups, assess your brand or category’s exposure, or gain feedback from your verified, GLP-1-using buyers, reach out to your Numerator team. We’re here to guide you through this next chapter in Canadian consumer behaviour.