To help support our clients during the Coronavirus (COVID-19) outbreak, Numerator will provide ongoing analysis into consumer behaviour and sentiment by conducting ongoing surveys of verified buyers. In addition to our standard US consumer insights, we have expanded our North American footprint to bring critical insights to the Canadian market leveraging our Canadian OmniPanel.

Access the latest version of these insights here. We will continue to keep all prior iterations of these survey insights available on our blog.

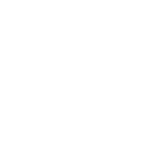

Across Canada, some regions have begun easing COVID-19 restrictions and moving into the early phases of their reopening plans. In this latest iteration of our consumer sentiment survey, we saw a decline in COVID-19’s impact on shopping behaviour and the level of concern consumers have regarding the virus. We also asked consumers how they felt about phased reopening plans, and which newly reinstated activities they were likely to resume in the coming weeks.

Canadian consumers more content with slowly re-opening than US consumers

49% of Canadian consumers said their regions had entered at least Phase 1 of a reopening plan, which allows some non-essential businesses to reopen their doors– this is significantly lower than the 71% of US consumers who said the same. Attitudes surrounding reopening were split– 54% believed their region was reopening at the right pace, 34% thought it was moving too quickly, and 12% believed reopening was overdue. This varies considerably from US consumers, who were more likely to think opening was overdue, despite the fact that more US regions are open.

Many consumers indicated an intent to resume personal grooming services, to shop at stores that were previously closed, and to visit public, outdoor spaces. They were unlikely to plan on dining-in at restaurants or going to bars, gyms or movie theatres, despite some regions allowing for the reopening of these types of businesses with proper social distancing measures in place. As we ease into the reopening process, businesses should expect a slow return to any out-of-home social activities and behaviours.

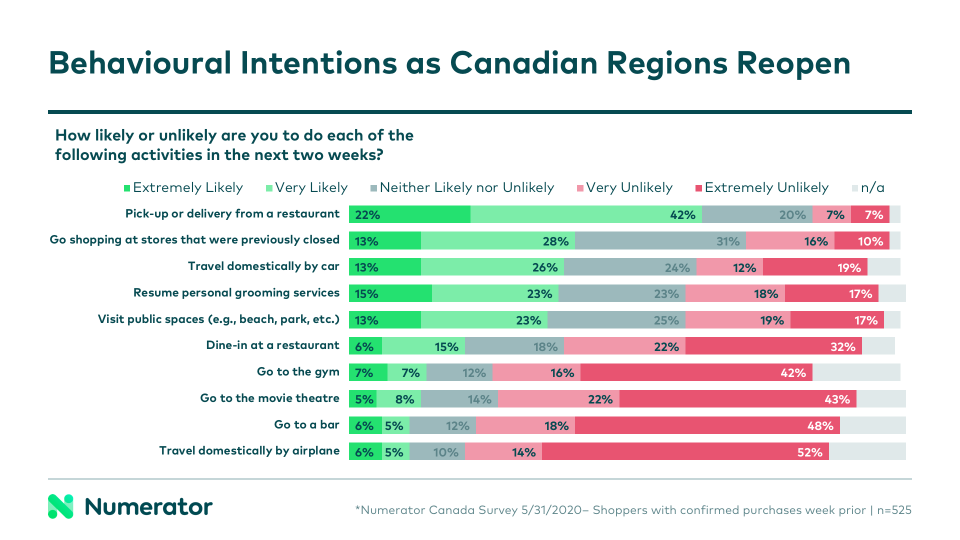

COVID-19 impact on consumer behaviour down from prior weeks

This week, 85% of Canadian consumers said their shopping behaviour had been impacted by Coronavirus, the lowest level we’ve seen in two months, and right in-line with US levels. Though the numbers are still high, we expect to see a sustained, slow decline in impact as more businesses get up-and-running again. However, given ongoing uncertainties, supply chain disruptions, and risks of potential resurgences in cases, it is likely we will continue to see fairly elevated levels of impact and occasional increases before we see a full return to normal.

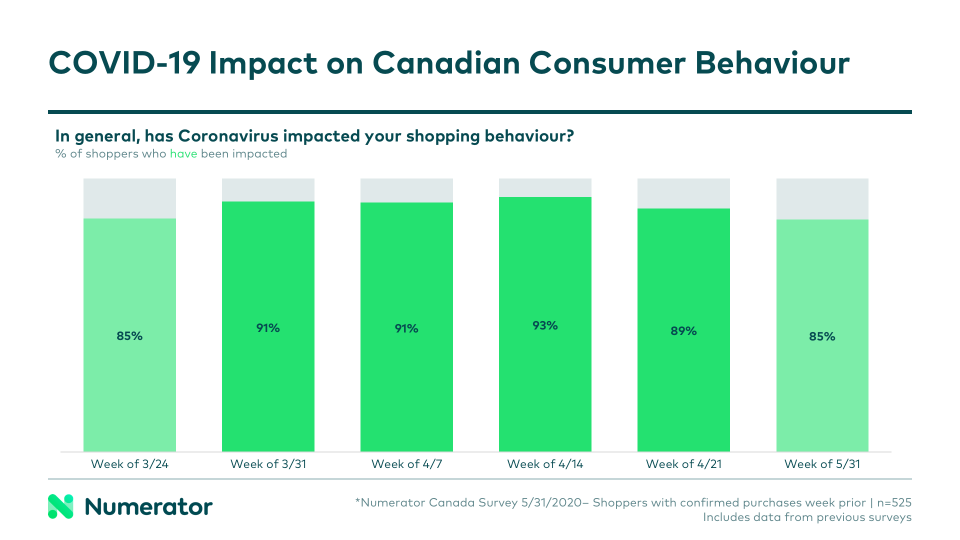

Online shopping surges while other behavioural impacts decline

Across the board, many of the shopping impacts we’ve seen as a result of COVID-19 were down significantly this week. This is expected, given the widespread reopening of many non-essential stores and businesses, and we anticipate continued declines as regions progress through their phased reopenings. Despite the reopening of in-store options, though, the use of online shopping continued to increase among Canadian consumers, indicating a new reliance on these methods that is likely to continue well past COVID-19.

Online delivery and click-and-collect services continue to attract new users

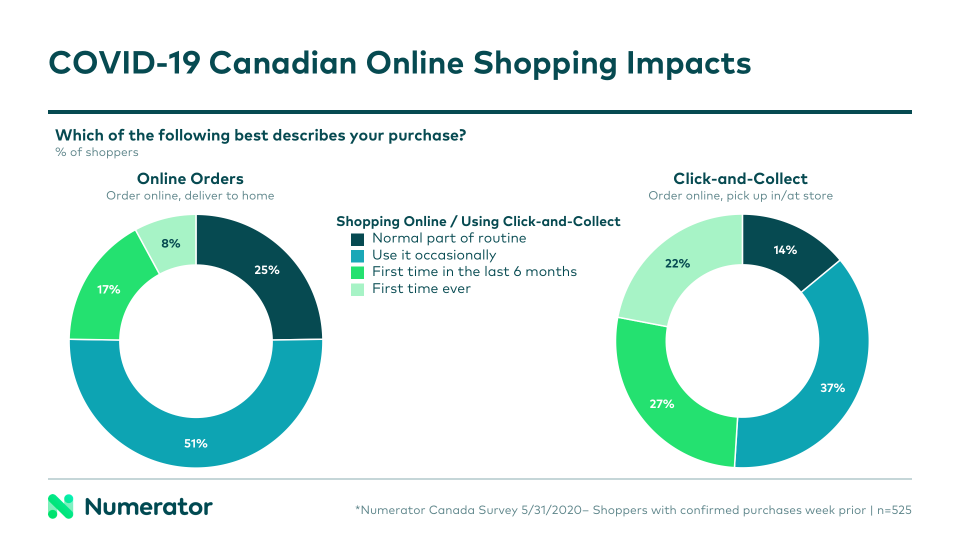

Three-fourths of Canadian consumers surveyed said they had placed an online delivery (ship-to-home) order in the past week, and nearly half said they had placed an online order for pick-up (click-and-collect).

25% of those who placed an online ship-to-home order indicated it was their first time ever or first time in the past six months doing so; 49% of click-and-collect users said the same. These numbers of new shoppers for online services are significantly higher than what we’ve seen in the US, where 12% of ship-to-home shoppers and 33% of click-and-collect shoppers are new or new lately. COVID-19 has brought about a drastic shift towards online shopping, particularly among Canadian shoppers who had previously been more hesitant to adopt these services. Retailers must continue to prioritize and invest in these delivery and click-and-collect options.

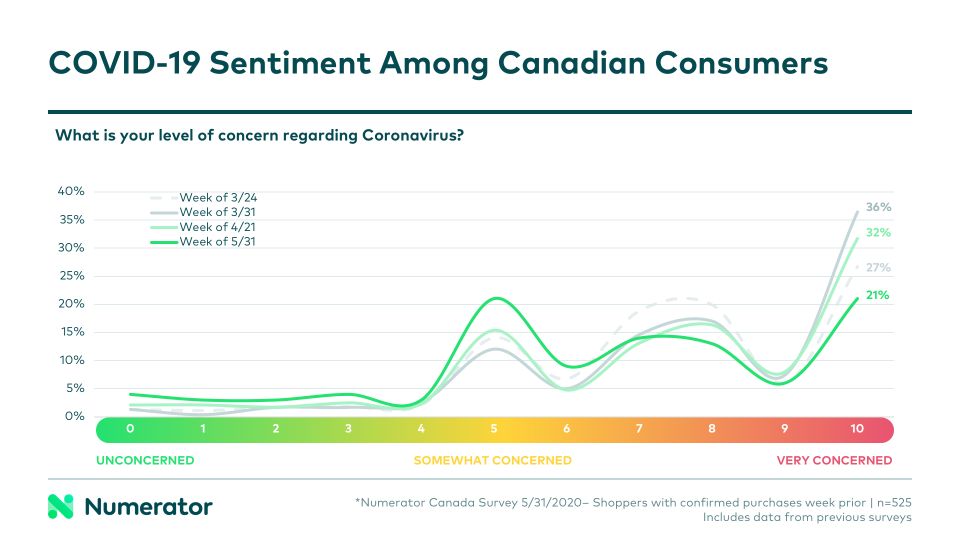

Concern over Coronavirus at lowest level since mid-March

This week, 21% of Canadian consumers rated themselves as “very concerned (10/10)” about Coronavirus, which is the lowest level we’ve seen since we began running our survey in early March. After reaching a peak in late March, we’ve seen a sustained decline in level of concern, which follows the trend we’re seeing in the US as well.

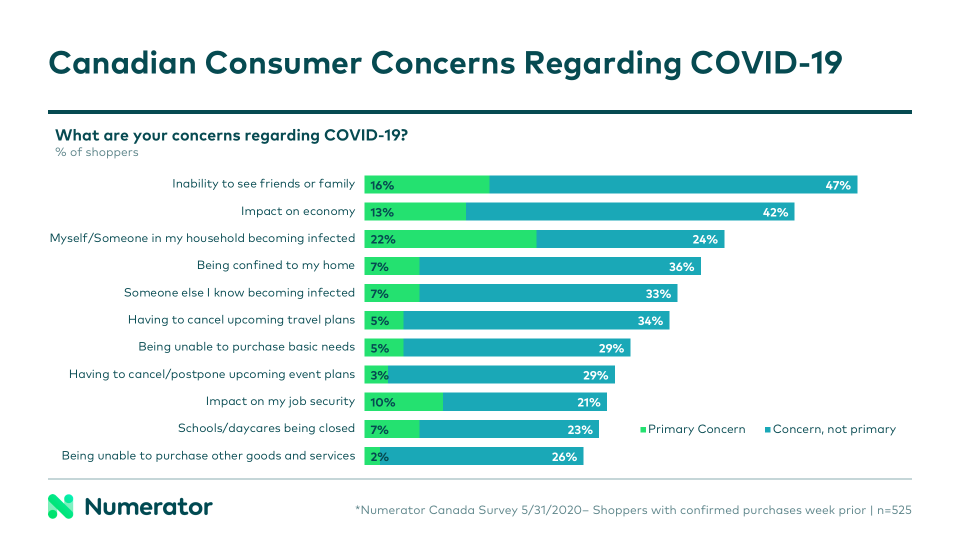

Inability to see friends and family highest concern among Canadian consumers

Canadian consumers were most concerned about their inability to see friends and family, compared to US consumers, who were most concerned about the economic impact of COVID-19. Economic impact and risk of infection were still some two of the primary concerns cited by Canadian consumers, though the levels were slightly lower than seen in the United States.

Looking Ahead

Given the fast-changing nature of the outbreak, we anticipate continued fluctuations in behaviour, impact and levels of concern in the coming weeks. As seen recently, even the lifting of stay-at-home orders will not be a quick-fix for businesses or consumers, but rather will initiate a slow return to a new normal. Now more than ever, it will be important to monitor consumer behaviour and sentiment in order to navigate reopening communities and adjusting to this new normal.

Numerator will be closely monitoring the situation to ensure brands and retailers have the most up-to-date information on consumer behaviour. For more information on how your brand or category is affected by COVID-19— in Canada or in the United States— please get in touch with us.