To help support our clients during the Coronavirus (COVID-19) outbreak, Numerator will provide ongoing analysis into consumer behaviour and sentiment by conducting ongoing surveys of verified buyers. In addition to our standard US consumer insights, we have expanded our North American footprint to bring critical insights to the Canadian market leveraging our Canadian OmniPanel.

We will continue to keep all prior iterations of these survey insights available on our website. This is the latest round of data, collected in a survey fielded through 9/30 to Numerator’s Canadian OmniPanel.

COVID-19 cases are rising across Canada, and while overall impact on consumer behavior is relatively stable, specific activities like stocking-up and experiencing product shortages have seen an increase. The rise in cases has led to a rise in concern among Canadian consumers, and more than four-in-five anticipate a widespread resurgence of the virus in the coming months, with another three-in-four expecting new lockdown measures on the horizon.

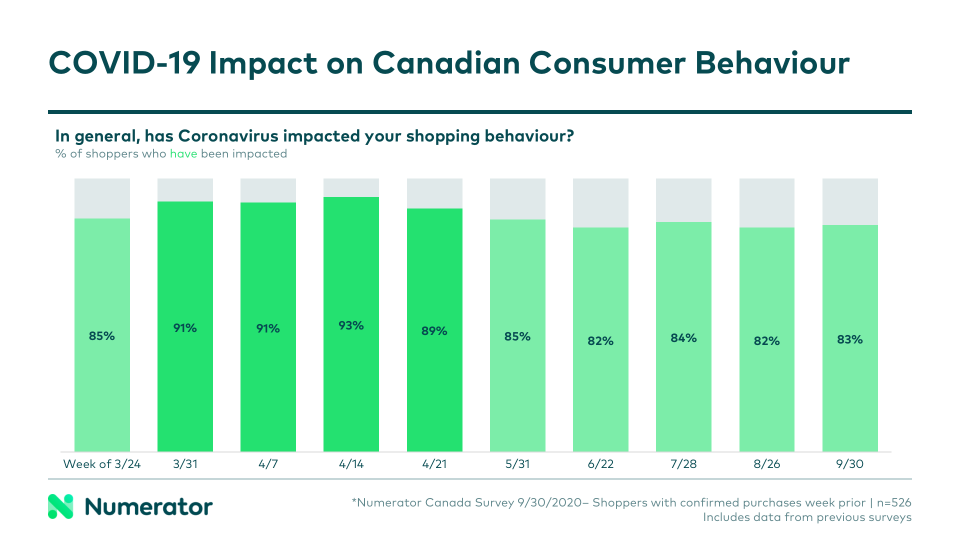

COVID-19 impact on consumer behaviour holds steady

This week, 83% of Canadian consumers said their shopping behaviour had been impacted by Coronavirus, in-line with previous months’ surveys. Given ongoing uncertainties, supply chain disruptions, and risks of potential resurgences in cases, it is likely we will continue to see fairly elevated levels of impact and occasional increases before we see a full return to normal.

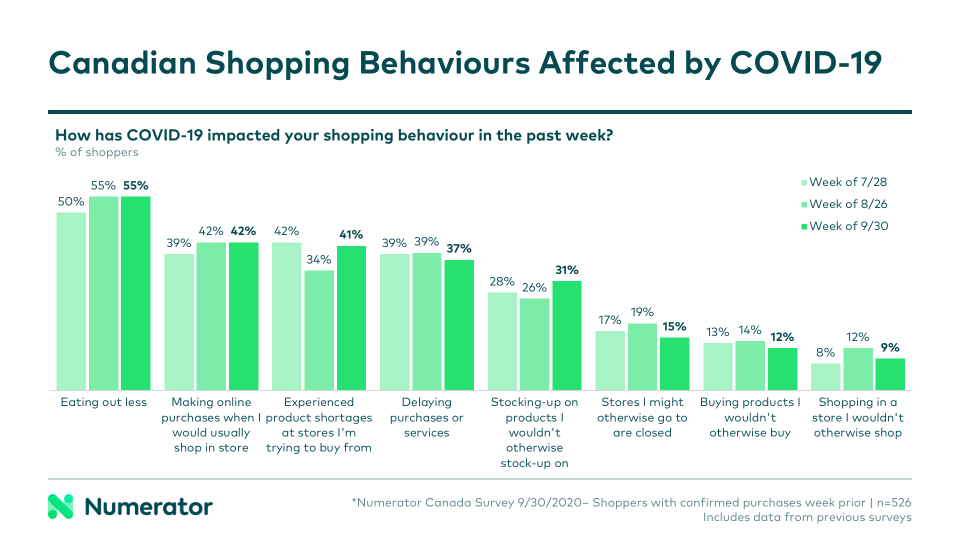

Slight uptick in a number of COVID-19 shopping behaviours

Consumers stocking up on products and those experiencing product shortages both saw an increase this month, while most other behavioural impacts saw a decline. More than half of consumers are avoiding eating out, and over a third are delaying non-essential purchases or services. Online shopping remains elevated, with two in five consumers opting for online in lieu of in-store shopping.

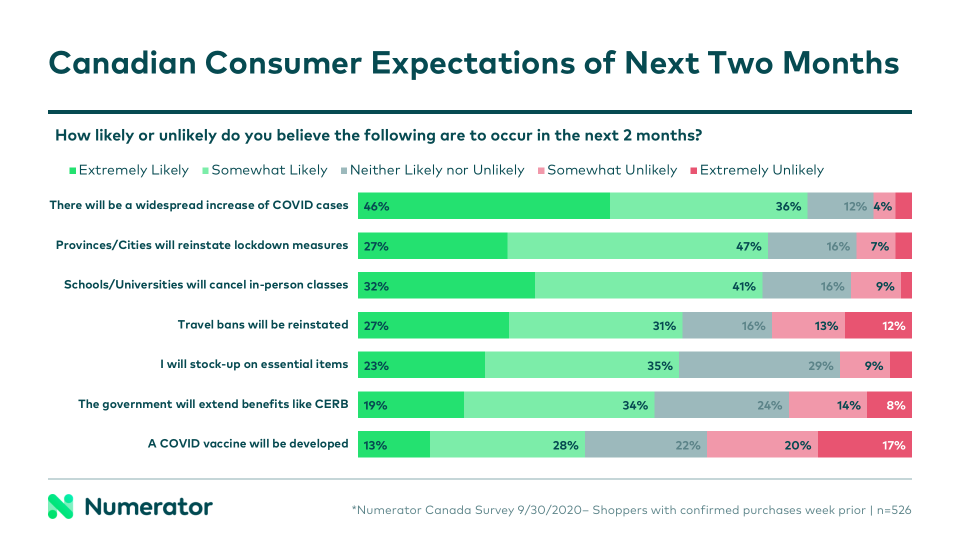

Consumers expect big changes in coming months

Changes in circumstances have a significant impact on changes in behaviour, and many consumers are anticipating significant changes in the next two months. Four-in-five believe there will be a widespread increase in COVID cases, and three-in-four think this will lead to lockdown measures and the closing of schools and universities, which could both contribute elevated at-home consumption. More than half of consumers think the government will extend benefits like CERB, and about two-in-five think a COVID vaccine will be developed.

Online delivery and click-and-collect services continue to attract new users

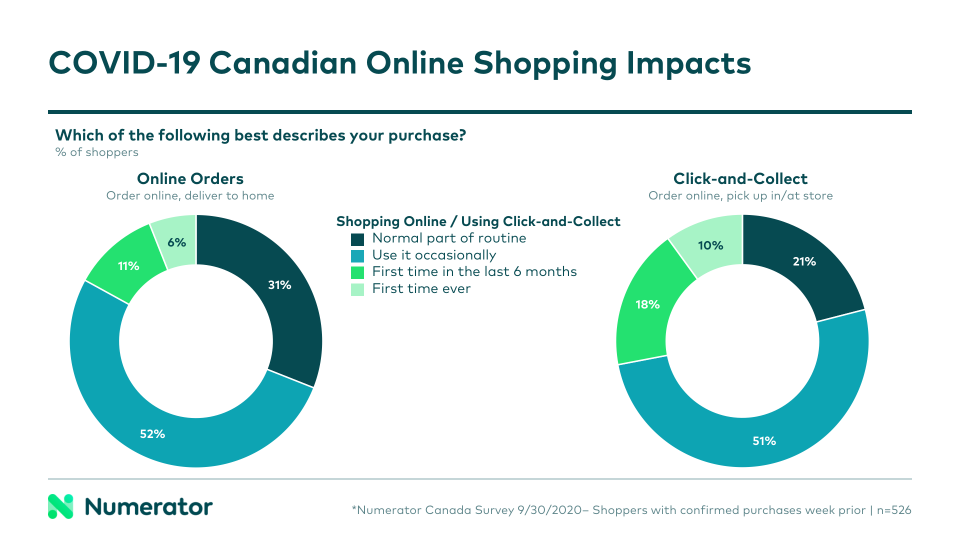

Two-thirds of Canadian consumers surveyed said they had placed an online delivery (ship-to-home) order in recent weeks, and two-fifths said they had placed an online order for pick-up (click-and-collect).

17% of those who placed an online ship-to-home order indicated it was their first time ever or first time in the past six months doing so; 28% of click-and-collect users said the same. COVID-19 has brought about a drastic shift towards online shopping, particularly among Canadian shoppers who had previously been more hesitant to adopt these services. Retailers must continue to prioritize and invest in these delivery and click-and-collect options.

Concern over Coronavirus on the rise

80% of Canadian consumers said their regions had entered at least Phase 1 of a reopening plan, which allows some non-essential businesses to reopen their doors. Attitudes surrounding reopening were split— 54% believed their region was reopening at the right pace while 36% thought it was moving too quickly.

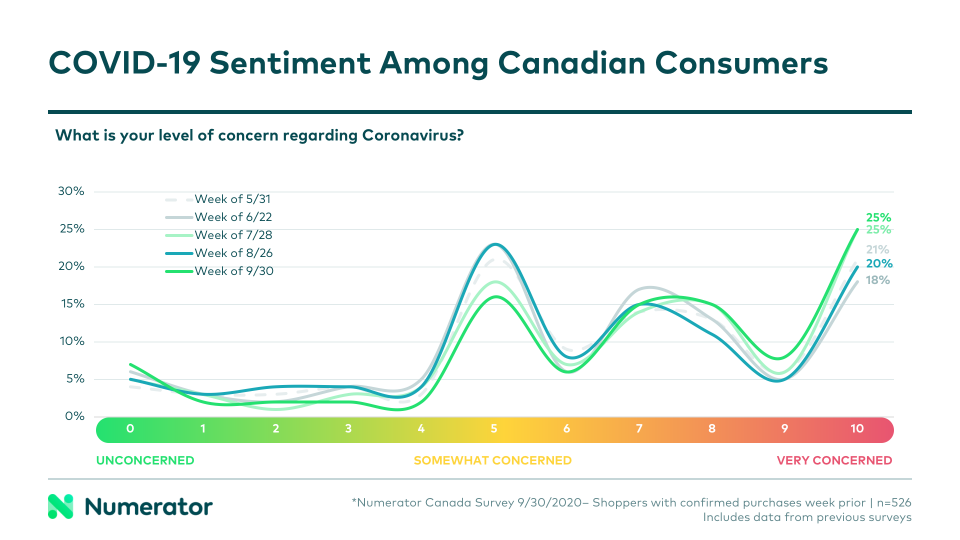

The majority (48%) of these individuals said the reopening had increased their level of concern regarding the virus, while many (43%) said their concerns had not changed. The overall level of concern rose significantly this month, with 25% rating themselves as “very concerned (10/10)” about Coronavirus, up from 20% last month, and in line with what we saw in July.

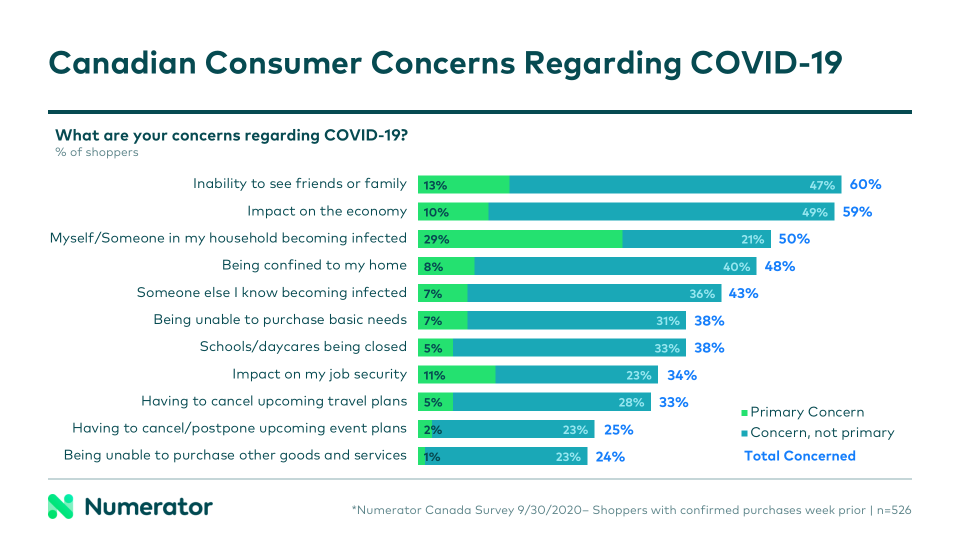

Impact on economy rises to top concern among Canadian consumers

Inability to see friends and family was the top concern among Canadian consumers, followed by the impact on the economy. 50% of consumers were also concerned about themselves or a member of their household contracting COVID-19, and 29% of consumers ranked the fear of infection as their top concern. Inability to purchase non-essential goods and having to cancel or postpone travel and event plans fell to the bottom of the list of concerns, but were still on the minds of more than one in four consumers.

Looking Ahead

Given the fast-changing nature of the outbreak, we anticipate continued fluctuations in behaviour, impact and levels of concern in the coming weeks. As seen recently, even the lifting of stay-at-home orders will not be a quick-fix for businesses or consumers, but rather will initiate a slow return to a new normal. Now more than ever, it will be important to monitor consumer behaviour and sentiment in order to navigate reopening communities and adjusting to this new normal.

Numerator will be closely monitoring the situation to ensure brands and retailers have the most up-to-date information on consumer behaviour. For more information on how your brand or category is affected by COVID-19— in Canada or in the United States— please get in touch with us.