To help support our clients during the Coronavirus (COVID-19) outbreak, Numerator will provide ongoing analysis into consumer behaviour and sentiment by conducting ongoing surveys of verified buyers. In addition to our standard US consumer insights, we have expanded our North American footprint to bring critical insights to the Canadian market leveraging our Canadian OmniPanel.

We will continue to keep all prior iterations of these survey insights available on our website. This is the latest round of data, collected in a survey fielded through 11/25 to Numerator’s Canadian OmniPanel.

As Canada grapples with a second wave of COVID-19, Canadian consumers face increased concerns about the impact of the virus on their day-to-day lives. Though cases are on the rise, COVID-19’s impact on shopping behaviour stayed relatively in-line with what we’ve seen in past months, indicating consumers have adjusted to new normals and may not see as many impacts to their shopping habits as they did during the first wave.

COVID-19 Has Changed Consumer Behaviour Long-Term

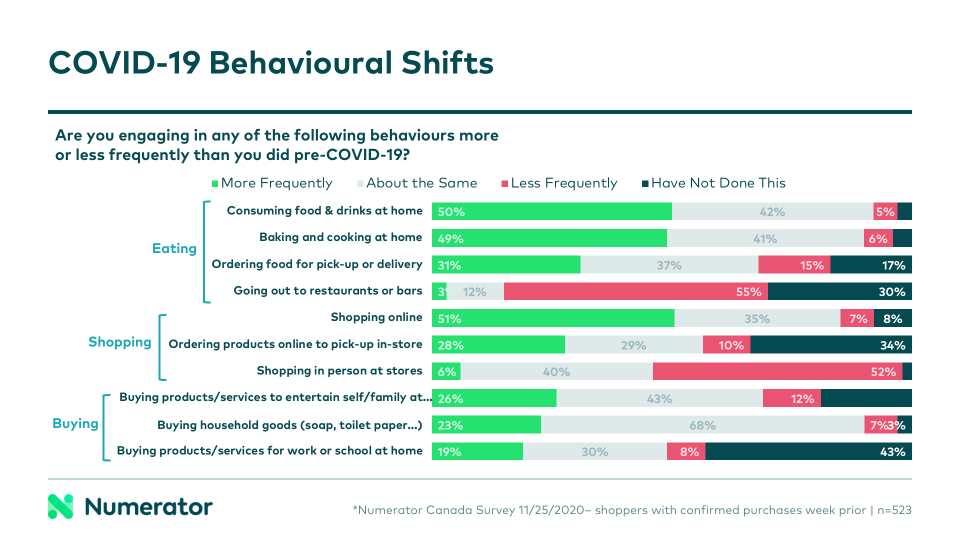

The way we eat and shop has drastically changed in light of the COVID-19 crisis. Half of Canadian consumers are eating and drinking at home more frequently (50%) and going out to restaurants and bars less frequently (55%) or not at all (30%). When it comes to shopping, 51% of consumers have increased their use of online shopping, and 52% have decreased how much they shop in person at stores. Long term, many expect these behaviours to stick—17% say they will continue to eat and drink at home more frequently even after COVID-19 is over, 13% expect to shop online more frequently, and 8% will continue using click-and-collect / buy online pick-up in-store services more than they did pre-pandemic.

Most Consumers Think a Return to Normal Will Take Six-Plus Months

Many Canadians are prepared for a prolonged return to normal, acknowledging that it is going to take longer than they previously anticipated. When asked how long they expect it to take before they can return to normal activities, 31% said they anticipated 6-12 months, and another 38% thought it would take a year or more. Only 3% thought a return to normal would come in under six months, and another 17% were unsure altogether. Compared to expectations a few months ago, 45% said they are now expecting a return to normal to happen more slowly than previously anticipated, while 47% said their expectations had not changed.

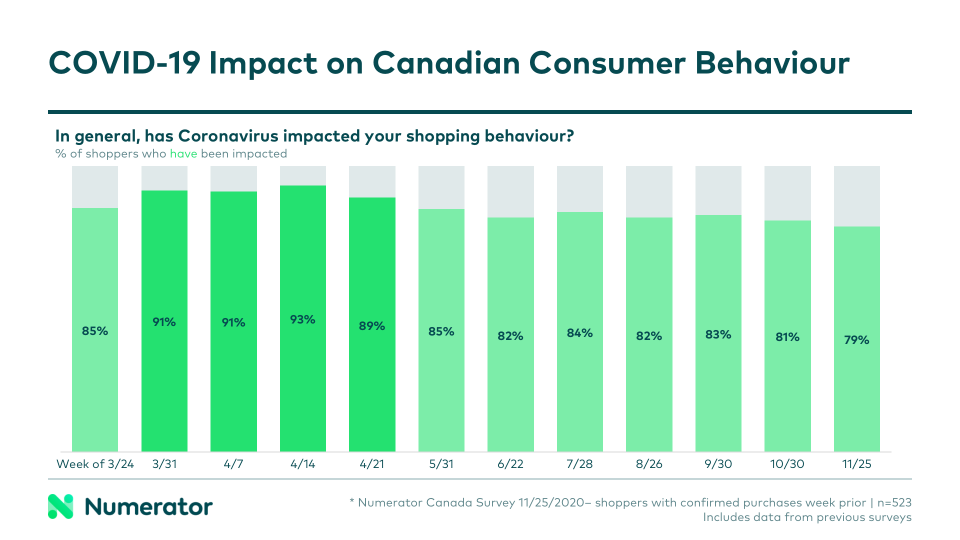

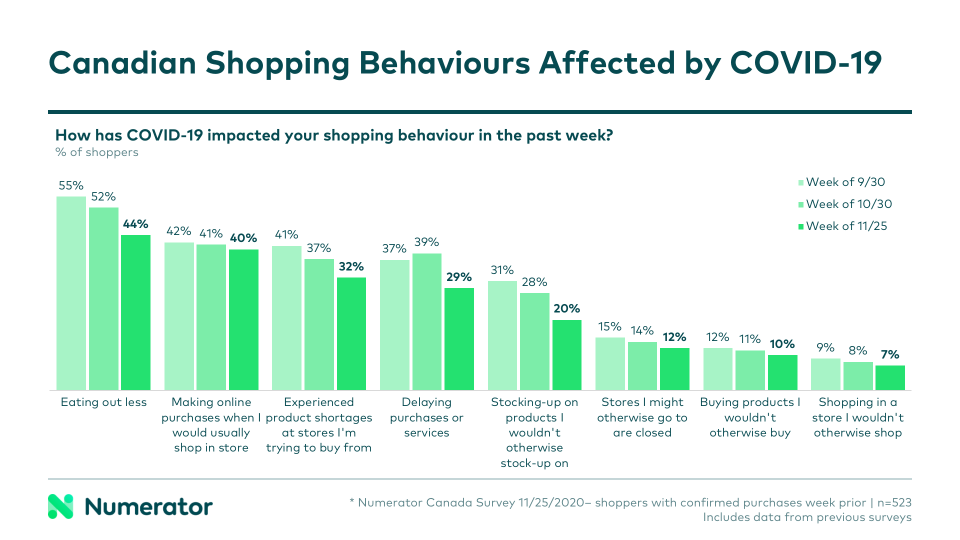

COVID-19 Impact on Consumer Behaviour Down Slightly from Last Month

This week, 79% of consumers said their shopping behaviour had been impacted by Coronavirus, down slightly from last month, and the lowest we’ve seen since the onset of the pandemic. Despite dealing with a second wave of the virus, consumers are learning to live with the restrictions that are in place and have found a routine in their COVID shopping behaviours.

Most shopping behaviours were down from what we’ve seen in previous months. Online shopping remained a popular option for many, with two-in-five consumers still replacing in-store trips with online orders.

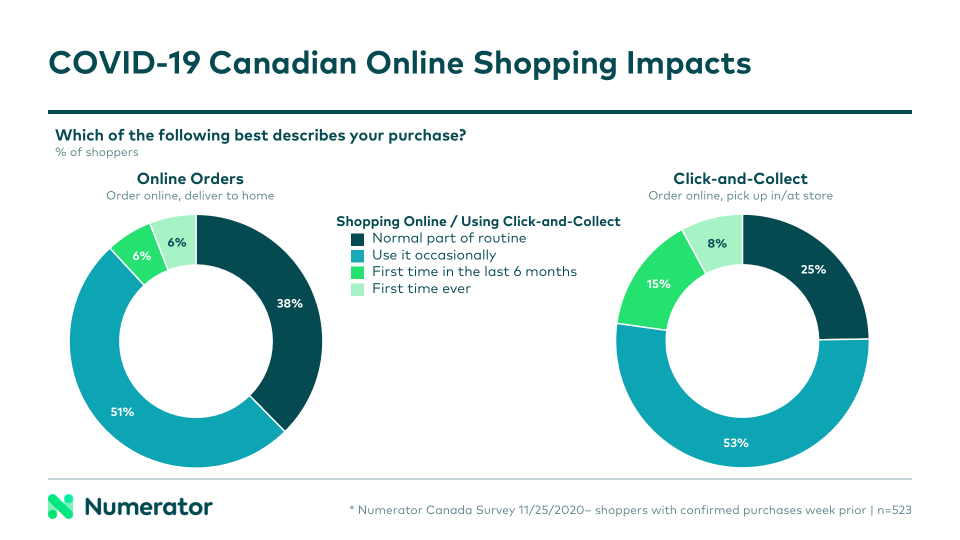

Online Delivery and Click-and-Collect Services Continue to Attract New Users

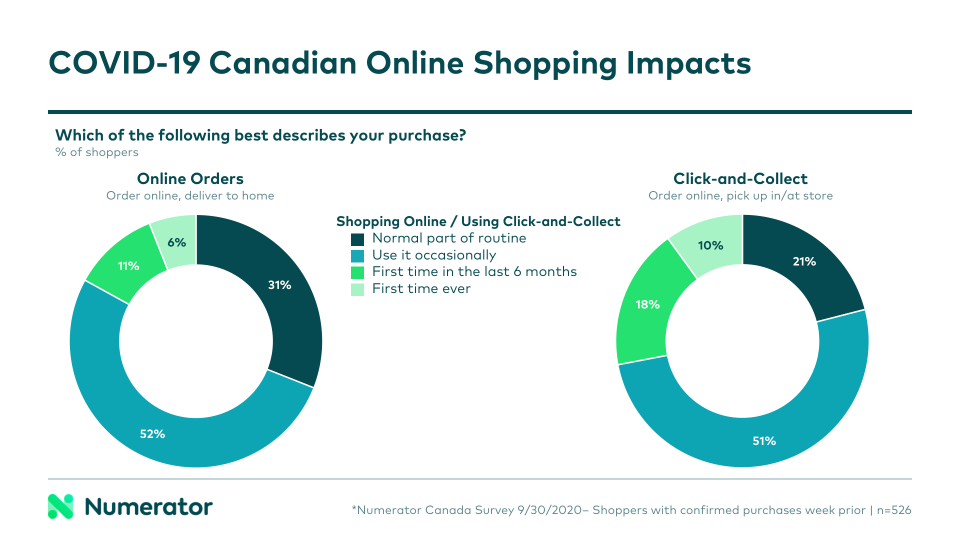

Two-thirds of consumers surveyed said they had placed an online delivery (ship-to-home) order recently, and one-third said they had placed an online order for pick-up (click-and-collect / buy online pick-up in-store).

12% of those who placed an online ship-to-home order indicated it was their first time ever or first time in the past six months doing so; 23% of click-and-collect users said the same. While these numbers will fluctuate week-to-week, the overall trend is clear: there is a large, sustained shift to online that doesn’t appear to be stopping soon. Retailers must continue to prioritize and invest in these delivery and click-and-collect options.

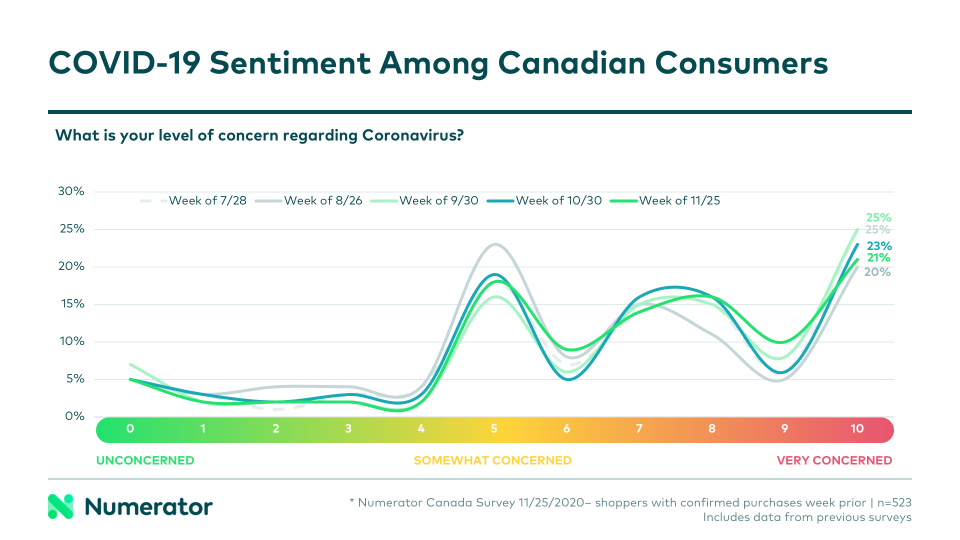

Concern Over Coronavirus Down From Prior Months

Despite the current surge in cases, level of concern was down from last month, with the number of consumers rating themselves as “very concerned (10/10)” decreasing from 23% to 21%. This is closer to the level of concern we saw at the end of August.

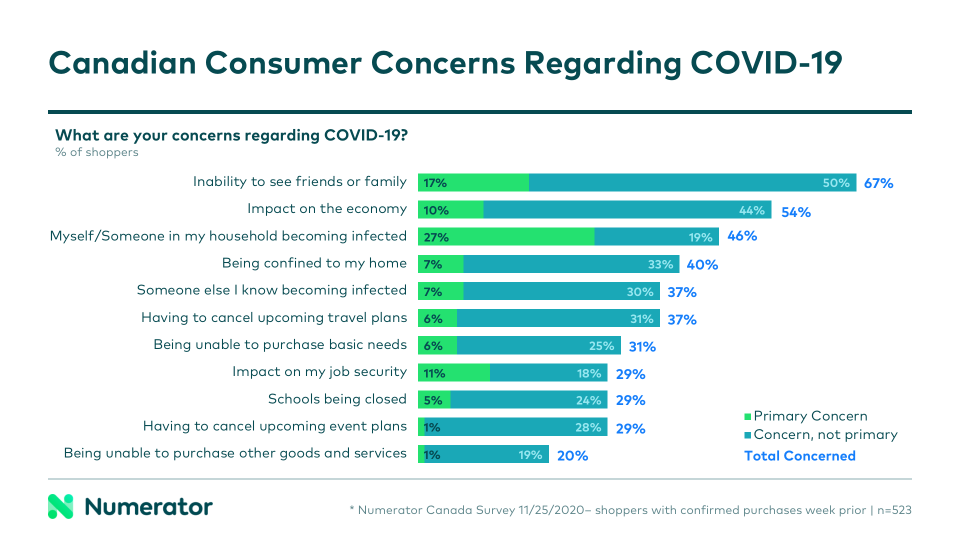

While the overall level of concern was down, many specific COVID-19 related concerns were up this month. Inability to see friends and family was by far the largest concern, impacting two-in-three consumers, especially prevalent during the holiday season. The economic impact of COVID-19 and the fear of getting sick remained at the top of the list as well, and fear of infection was the primary concern for the largest number of individuals.

Looking Ahead

Given the fast-changing nature of the outbreak, we anticipate continued fluctuations in behaviour, impact and levels of concern in the coming weeks and months. With cases on the rise across the country, it is likely we will begin to see behaviours and sentiments closer to those of the spring. However, adjustments made by retailers in light of COVID-19 and a broader understanding of safety precautions and risks is likely to lessen the behavioural impact slightly.

Numerator has fielded twelve iterations of our Canadian Coronavirus Consumer Sentiment Survey since early March. Moving forward, we will be re-tooling our survey and changing the way we share in order to keep it relevant and useful for our clients. In addition, we will continue to publish a variety of resources to help you understand COVID-19’s impact on consumers.

We will be closely monitoring the situation to ensure brands and retailers have the most up-to-date information on consumer behaviour. For more information on how your brand or category is affected by COVID-19— in Canada or in the United States— please get in touch with us.