With vaccinations on the rise and COVID cases on the decline, Canadian consumers have plenty of reasons to feel hopeful about the future. That optimism is spreading to school grounds, too, as most provinces plan to reopen and welcome students back for in-person classes this fall. What changes will the familiar clang of the school bell bring about during this year’s back-to-school shopping season?

Doing our data homework, we shed light on the attitudes and behaviours of back-to-school shoppers in our latest webinar. Using our sentiment and back-to-school surveys along with Numerator Insights, Promotions and Ad Intel data, we revisit the trends of 2020 and uncover the current consumer outlook and purchase intentions for the 2021 season. With 51% of parents and guardians expecting their kids to be at school desks full-time come September, back-to-school shopping is back in session.

Consumers Remain Cautious Heading into the New School Year

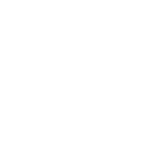

Our monthly Sentiment Survey found Canadian consumers generally less concerned about COVID-19 now than in recent months. Plus, consumers are growing increasingly comfortable participating in regular activities like eating at restaurants, traveling, and gathering with friends. Though caution continues to be their guide, consumers are feeling very optimistic about the road ahead with many anticipating to resume a pre-pandemic lifestyle by year’s end, if not sooner.

On the other hand, consumers remain concerned about the economy, and sales and spending reflect that sentiment. Weekly trips are higher than lockdowns last year, but not yet back to pre-COVID levels. Spend per trip is still higher than pre-COVID levels but not as high as during the lockdowns.

Lessons Learned from the 2020 Back-to-School Season

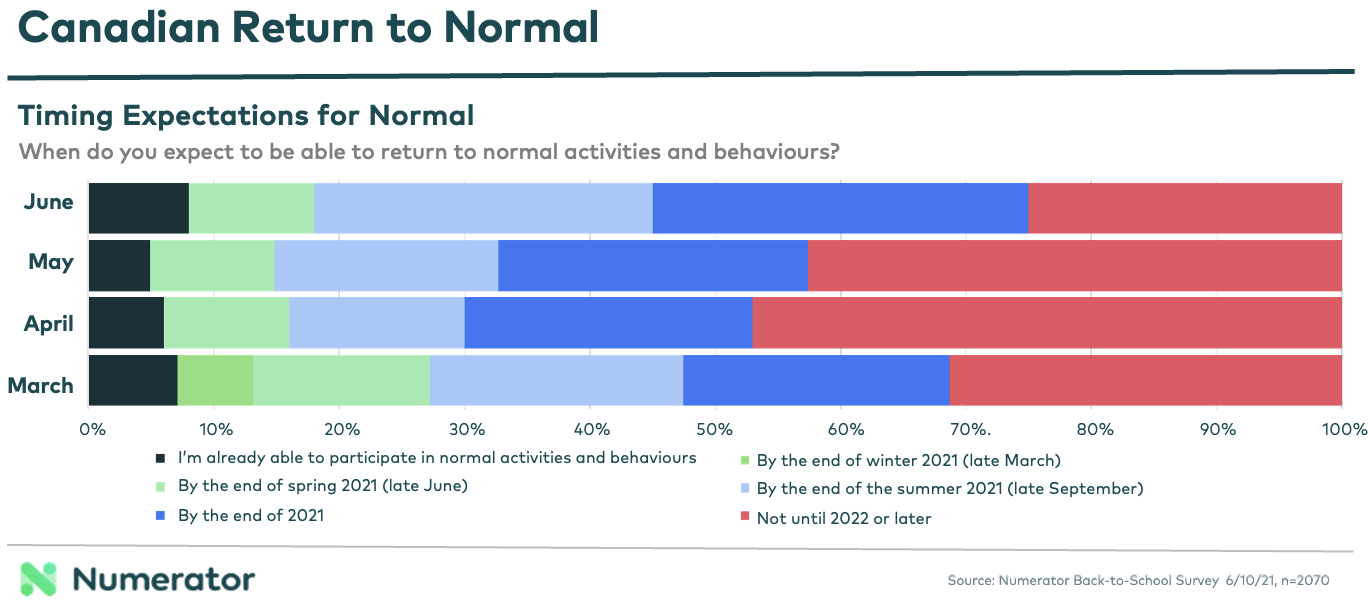

The sudden switch to virtual and hybrid learning in 2020 produced significant shifts in shopping behaviour. Parents and guardians relied on bigger basket sizes and more comprehensive school supply purchases, likely due to facing a range of learning options and uncertainty around how the school year would continue to unfold. Key back-to-school categories such as food and lunchbox essentials performed slightly above average, and cleaning supplies in particular saw a notable bump of nearly 15%.

Retailers took their cue from this shift and aligned their messaging to match changes in the educational environment. Not only was there a decline in back-to-school messaging overall, retailers leaned more heavily on digital advertising as opposed to TV, radio, and print, which was likely more cost-effective and easier to revise under changing circumstances. Promotional flyers also made a big move into the digital space in 2020, a trend that remains strong this year despite the swing back to more normal activities, including in-person schooling.

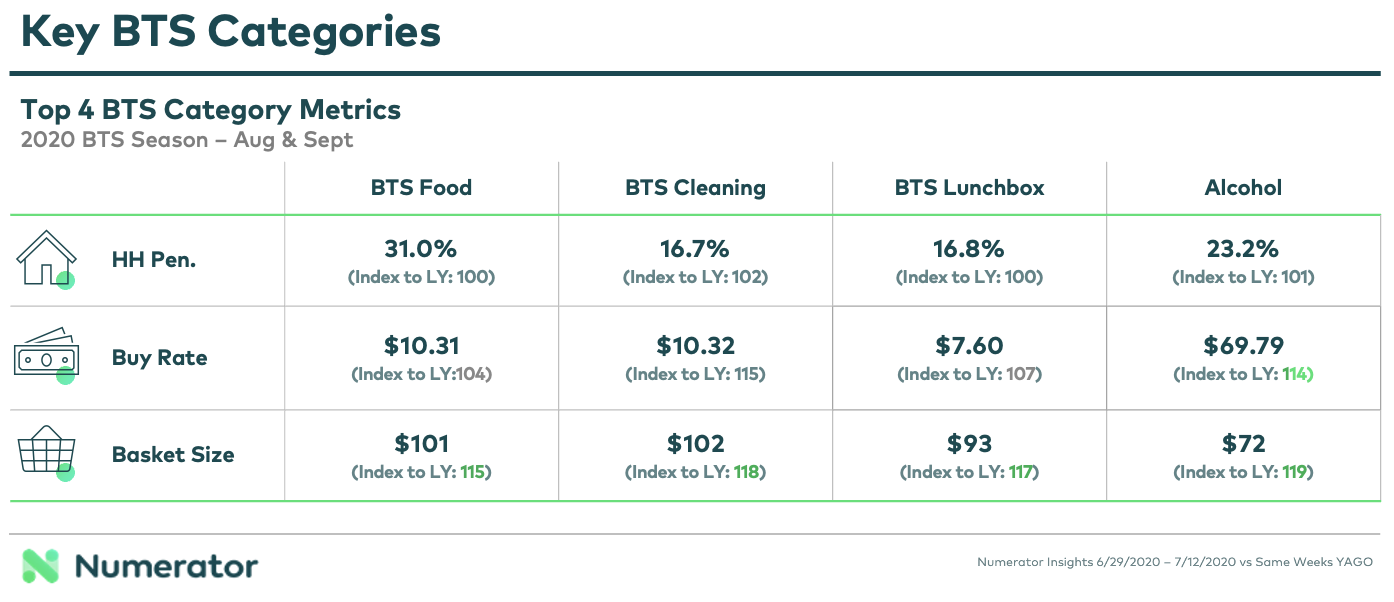

All Aboard the Back-to-School Shopping Bus

What do cautious consumers plus the promise of in-person classes add up to for the 2021 back-to-school season? While we found 1 in 2 households expect their children to be exclusively back on school grounds, 20% of families are still unsure of what September has in store. This means virtual and hybrid learning classes have yet to be completely dismissed. However, in spite of some ongoing uncertainty, 85% of parents and guardians plan to buy school supplies, indicating this year’s back-to-school season is getting back on track with years past.

A majority of parents will begin their back-to-school shopping in early August, which is typically peak season, and make the most of their purchases in-store. In fact, 34% of parents plan to bring their kids shopping with them. Parents of students resuming in-person learning say school staples like clothes, shoes, backpacks, and lunchboxes are back at the top of their shopping list while snacks, lunch foods, face masks, and cleaning supplies become less important. Meanwhile, parents of virtual learners plan to purchase more supplies this year, but will spend less overall on most back-to-school categories.

Looking Ahead

Optimism is high, but caution continues to govern Canadian consumer attitudes and behaviour. That said, the 2021 back-to-school season is on track to achieve high marks with key indicators marking a measured return to normal. We expect to see an increase in back-to-school spending and in-store traffic, especially from families of students rejoining their classmates on school campuses. Ecommerce will still play a role, particularly for students staying home, but bricks-and-mortar retailers and manufacturers should prepare for an influx of returning customers and consider strategies to position their back-to-school offerings while ensuring in-store shopping is safe, efficient, and easy.

We invite you to listen to the webinar replay for additional details on the shifts in consumer intentions and behaviour as well as category and messaging trends heading into the back-to-school season. As the season progresses, monitor shopper behaviour using Numerator Insights and leverage our Promotions & Ad Intel solutions to remain competitive with your messaging and promotions. Our Instant Surveys are also ideal for gauging shopper sentiment both before and after the back-to-school season so you can plan for 2022.

To learn more about how your brand or category is affected by the back-to-school season, please contact your Numerator Customer Success Consultants or get in touch with us.